- November 19, 2024

- Posted by: Visa Imigration

- Category: where to get payday loan

Markets Leader, Virtue Financing

Looking for a house inside Charlotte, Perfect Slope, Belmont otherwise Monroe? When you find yourself like any some body we talk to we wish to get the home loan that a great) you can buy approved to own and b)comes with the ideal words. FHA Fund for the Charlotte are one of the most searched for software offered. More folks want to get a house prior to home prices rise an excessive amount of, and FHA Financing features easier than you think being qualified and provides a good low-down commission away from step 3.5%. The program is just readily available for good Proprietor Occupied Home buy. FHA Loan Restrictions Charlotte try staying at an identical place for 2017.

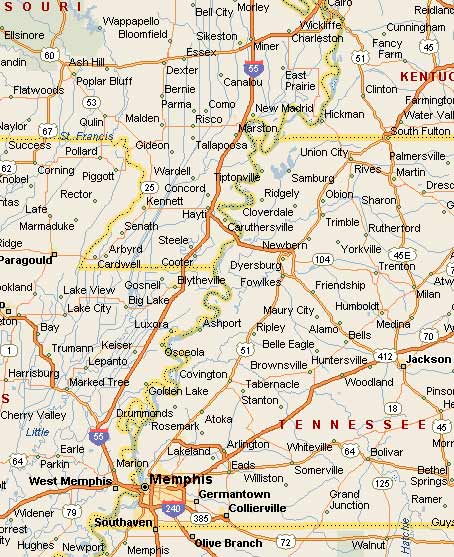

Instead of qualifying getting an excellent Va Mortgage (the place you have to be a being qualified Veteran) otherwise good USDA Mortgage (that requires you meet money restrictions for the state and the house need to complement within the USDA RD Financing Impact) FHA provides fewer restrictions! They do keeps Limit Mortgage Amounts, and therefore are different for every condition. Maximum money number restrictions is actually at the mercy of changes annually, and it’s really established the new median cost of property where city.

- One Nearest and dearest House: $280,600

- Two family Hold: $359,2 hundred,

- About three Members of the family Hold: $434,2 hundred

FHA Loans try having Manager Filled Tools, simply. While to invest in a multiple-friends you would need to live-in one of the products, but FHA do enables you to rent out others top, and can include you to earnings on the obligations so you can income being qualified rates.)

NOTE: The newest 2017 FHA Loan Limitations to possess Charlotte, Monroe, Belmont is over the fresh had written speed for the certain web sites they altered that have Situation Number pulled immediately following .

FHA loans has pretty effortless credit score criteria. We want at the least an excellent 600 middle credit history in order to be considered extremely individuals. Top home loan cost for it system is currently supposed to those having at the least a good 680 middle credit score. If you had a bankruptcy, Chapter 7 otherwise Part 13 try to waiting within minimum two years from the date of the launch. You will find guidelines out one to claim that if you have good Section 13 and you have made at the very least one year out-of payments you should buy property… along with specific strange state it could works but we have perhaps not succeeded with that condition. In addition, if your A bankruptcy proceeding case of bankruptcy in it foreclosed possessions ( or if you got a foreclosures or a primary product sales) attempt to waiting a full three years before purchasing a new home.

Low Conventional Borrowing: There are times when we have been in a position to generate borrowing from the bank for an individual exactly who did not have about step three trade traces. If you find yourself for the reason that condition we highly recommend you have made a couple of Secure Playing cards.

FHA Funds accommodate brand new off-commission away from step 3.5% to come out of your fund, from a present, of a manager or Non-money, or a grant for instance the NC Reasonable Construction Program. The NC First time Family Customer System can be obtained of these who’re citizens out-of NC and possess come renting into last 36 months. The fresh NC Sensible Housing System offers a lot of benefits you to definitely can be utilized with FHA Financing from inside the Charlotte, for instance the MCC Home loan Taxation Borrowing, reasonable mortgage interest rates, and good forgivable step three% grant which can be used for the downpayment or perhaps to defense closing costs.

The NC Very first time Homebuyers Program does not have an effective limitation sales price during the Charlotte. The amount of money limits to the system try at the mercy of transform per year as they are centered the newest average money towards Condition. The application do allow us to create modifications towards Earnings constraints reliant childcare and you will certain deductions absorbed new past two years on your income tax come back, so if you are intimate, please contact us for more information. (how to calculate income)

- 2017 Money Limits to possess Charlotte, Monroe | Mecklenburg State

- $87,five hundred ‘s the maximum money restriction.

- MCC Financial Income tax Borrowing from the bank to have children with step 3 or more people is actually $81,000

Based upon you to definitely meaning, we think that the title Very first time Family Visitors Offers ‘s the suitable usage of words to spell it out the fresh software we try dealing with. The Exact Label for this cash is Forgivable Financing. Hardly any people are regularly one to term, thus, again we call them Financial Grants.

Is there one desire, or any other fees energized about money?

For the money designed for advance payment towards a property away from NC Houses Fund Service (NCHFA), the answer was Zero. There’s a charge for the installing the borrowed funds Credit Certification (MCC), and there try brief fees with the some of the almost every other municipality reasonable houses funds available. New charge will vary because of the Agencies, very you will see the exact payment costs as soon as we determine and that program is best suited so you can buy a home.

The brand new Advance payment Advice Program, or Offer (any kind of identity we would like to call it) Is the home mortgage. Meaning your submit an application for the newest down payment advice about an equivalent bank you sign up for the loan which have. They go hand-in-hand.

You ought to over a mortgage software. Can be done one on this website (comprehend the environmentally friendly button to the right?), you can also e mail us (919 649 5058), you can also are in.

Five Something loans Louviers First time Home buyers when you look at the Vermont should be aware of

FHA is served by an alternate degree / underwriting guideline, that allows that buy a house, which have a family member that will not reside in our house… The brand new FHA Low-Consuming Co-Signor Program is usually, known regarding Mortgage Community once the a great Kiddie Condo, while the in all honesty it’s good for to purchase a house to have kids for the university!

As opposed to renting a dormitory, of several NC moms and dads place the student toward mortgage loan and you can buy a property, splitting the latest lease with individuals! We additionally use this method to have 55+ grownups exactly who with ageing mothers who will not, for reasons uknown, qualify to invest in a property and youngster helps this new father or mother qualify for a mortgage loan.

Wanting a property about Charlotte / Monroe area? Recall the FHA Loan Restrictions to own Charlotte just ran up! Label Steve and you will Eleanor Thorne 919 649 5058. We manage A great deal of FHA financing within the Charlotte NC and you will we’d prefer to make it easier to! We also provide a few of The current Greatest Financial Prices into the Charlotte and Monroe NC!