- August 4, 2024

- Posted by: Visa Imigration

- Category: paydayloancolorado.net+bonanza how much can you get on a payday loan

Review

Quicken Finance expectations in order to interrupt the borrowed funds market employing the fresh new Skyrocket Financial. Know the goals and just how you can purchase property loan in only 10 minutes within Rocket Home loan remark.

Editor’s Note

You can trust this new ethics in our well-balanced, separate financial guidance. We possibly may, although not, receive settlement on issuers of a few points mentioned in this post. Feedback certainly are the author’s by yourself. This content wasn’t provided by, analyzed, recognized otherwise recommended from the one marketer, except if if you don’t detailed less than.

For decades, Quicken Money has prided alone toward as the ideal on the web mortgage broker in the city. Its easy app processes enjoys aided they become certainly one of the most significant mortgage businesses in the industry, bookkeeping getting 6% of your own mortgage loans in the us.

That throws him or her directly behind financial monsters such as Wells Fargo and you will Chase on the race to manage mortgage business. Pretty good to have an online representative.

Even with almost all their achievement, new Quicken Fund software procedure is not a completely on line feel. Sure, potential individuals become the applying processes on line. But as with any other mortgage company, submitted applications got to help you financing officer exactly who following led the fresh new applicant from process. That is how it provides usually did…so far.

Get into Skyrocket Mortgage, Quicken Loans’ treatment for the modern need for fully on the internet deals. Today, financial applicants can be intimate the entire loan application process in the place of actually ever being forced to correspond with various other individual. That’s a fairly unbelievable performing, therefore you will entirely replace the way Us citizens sign up for mortgages. In reality, Dan Gilbert maker out of Quicken Money recently told TechCrunch that he believes Skyrocket Financial will be good disruptor home resource area similar to how the new iphone disturbed new cellular phone field. When you take a look at the unit, it’s difficult to not faith their hype.

Just how Skyrocket Financial Really works

Rocket Financial is changing the overall game for home loan applications. They automates this new verification techniques, removing the requirement to post any banking information to help you a person being (normally multiple times). Because somebody who has applied for multiple this new mortgage loans and you can refinanced some someone else, I’m able to find out how the techniques could be a massive be concerned reliever and you may time saver. Actually, I’m shocked that it is drawn so long getting a mortgage representative commit so it route.

Access immediately on financial info was unbelievable. Nevertheless foremost feature regarding Skyrocket Home loan is the feature so you’re able to agree the fresh new finance from the super speed, reducing new prepared several months on borrower. Skyrocket Mortgage is agree software in less than 10 minutes! That is unbelievable, and you may an enormous reason that this action can be extremely effective.

The fresh new user interface is easy and you may straightforward, as well as the program procedure itself. Rather than simply throwing hard to know raw models to your display on exactly how to fill out, Skyrocket Mortgage makes it simple from the requesting several concerns. Your own remedies for men and women inquiries should determine the way the remainder of the fresh interviews goes. Just like a modern tax system, Skyrocket Home loan then imports the approaches to just the right variations.

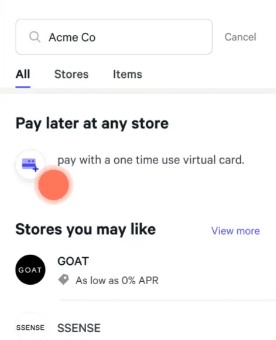

The process starts from the asking whether you’re buying a home or refinancing a preexisting financial. According to and therefore switch you select, the rest of the techniques was customized to fit one purpose. Borrowing of automated monetary products such as for instance Private Investment and you can Improvement, Rocket Home loan will ask you to hook up debt levels so you can payday loans locations in Bonanza their program. This permits them to look at your financial statements on line in the place of your having to publish them brand new real duplicates of financial recommendations.

Immediately after typing all the associated advice, you can make use of discover an entire real-time itemization of the costs, interest rates, and you will estimated commission. Courtesy a simple group of sliders, you might to change the duration of the loan otherwise get circumstances to decrease your own monthly premiums. Whenever you are proud of that which you come across, hit the fill out key in order to protect your own rates and send the application of to own instantaneous recognition.

Skyrocket Mortgage Positives and negatives

Recognition within a few minutes – As Skyrocket Financial requires you to hook up debt accounts, you’ll have the loan recognized in minutes.

Real-go out Visibility – Immediately after doing the newest questionnaire, you’ll be able to observe how to buy circumstances or changing the latest name of your loan can affect your own commission agenda by way of actual-time information.

Personal Within this weekly – Your loan using Skyrocket Financial and you can Quicken Loans is also intimate inside a week, considering 3rd-activities don’t reduce the procedure.

For as much as it is a bonus, without the ability to talk to an individual loan administrator may potentially be a drawback as well. By the Do-it-yourself character out-of Rocket Mortgage, people can get lose out through the use of getting a home loan this is not always the leader because of their condition. Certified individuals often have multiple financial available options to them. Because most people are maybe not financial gurus, this will be an area in which an individual loan manager you are going to assist lead their visitors about right recommendations.

Can it Works?

At this point, we could only guess how personal usually answer Rocket Financial. While the advantages of the program tends to be welcomed from the specific, particular do-it-yourselfers try destined to earn some high priced errors. That is going to carry out specific extremely let down people, even when the blame is completely their own.

You’ll be able that customers could possibly get decide that they need a whole lot more people communications. Speaking of huge figures of money our company is talking about here. not, if you have ever taken out a mortgage, you more than likely prayed to get remaining alone because of the home loan company will ultimately when you look at the processes. Therefore, my impression would be the fact people are gonna like it.

Its far too early to understand in the event Quicken Loans’ huge enjoy towards the Rocket Financial will pay from. Just go out will state when it it really is disturbs the loan markets since it is able to do. However,, within age of expanding automation and you will interest in a lot more buyers handle, it looks like Rocket Mortgage is actually a strong choice ahead away a champion.