- January 22, 2025

- Posted by: Visa Imigration

- Category: how much payday loan can i get

This article will look at a couple of number 1 credit selection you to home investors consider, if it is antique financing, or private (hard money) money specifically for those people exactly who get and you may improve residential and you will multifamily qualities having an ultimate sale (augment and you will flip) or transforming to your accommodations property on conclusion.

Once again, there are numerous other options (and you can differences) of those, but it’s extremely important one real estate buyers has a thorough comprehension of this type of number 1 options to thought near to their capital expectations. Keep reading for additional info on these specific resource selection so youre finest in a position to discover and that option provides your needs.

What is actually individual currency credit?

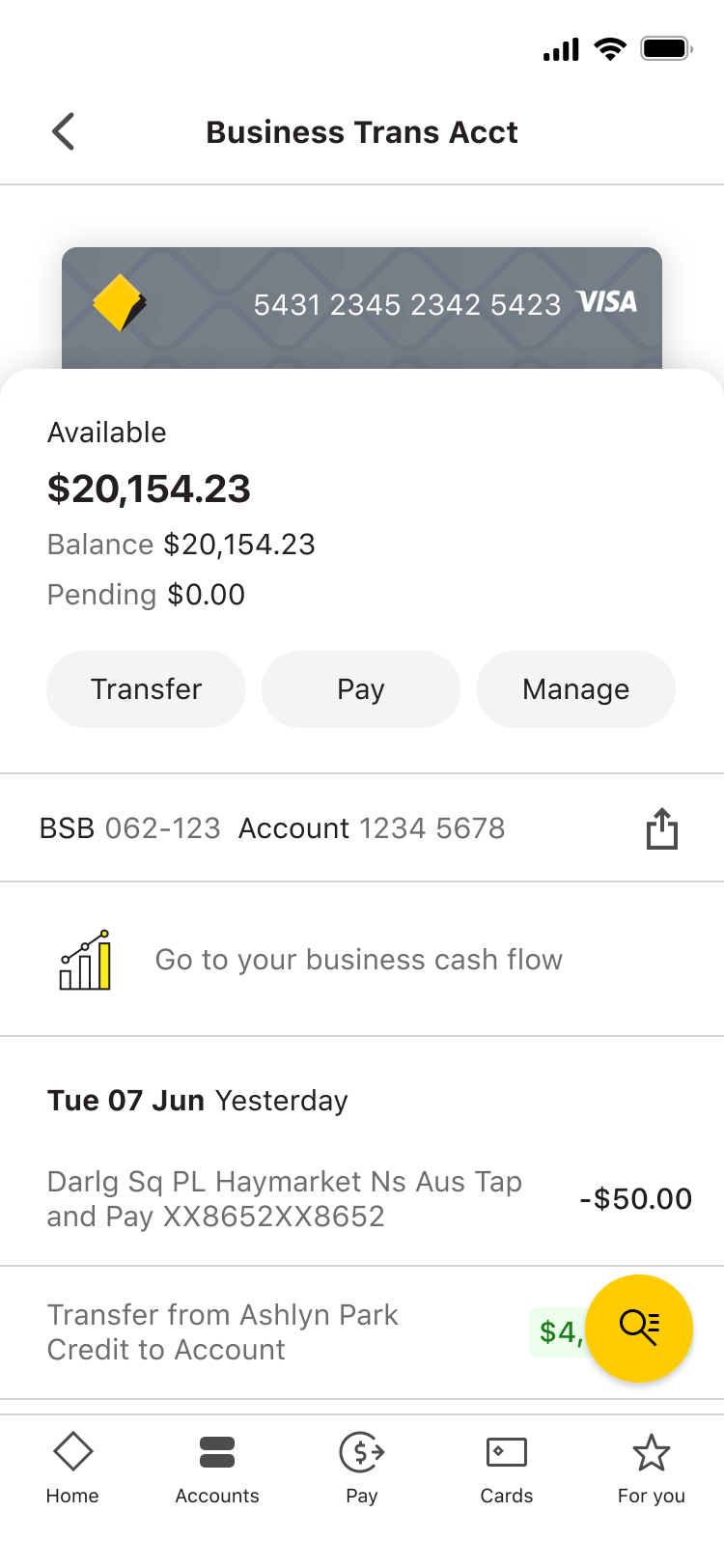

A private money loan is a preliminary-name financing secure from the a house and certainly will additionally be called so you’re able to as a hard currency financing. These financing are generally funded because of the Personal Lenders who happen to be in the course of time supported by individual traders. Due to the fact Private Lenders just remember that , of numerous real estate traders keeps a good short-label business strategy to get into and you may regarding a house to own a revenue, fund associated with the character normally have a dozen-week terms and conditions. At exactly the same time, as Individual Loan providers just remember that , a home investors commonly brand new normal $five-hundred,000 a year W-dos money earner, certain requirements are a lot so much more versatile:

- Large power facts

- Down borrowing requirements

- Zero earnings criteria given that after all this is a good investment, perhaps not a property that you’re trying are now living in

- High rates of interest, not, repayments is actually Interest only Monthly obligations

Now you may be considering, how much money is also loan providers provide to the fresh borrowers? It simply comes down to a personal Lender’s capacity to learn what a property investors do to give, not just resistant to the current worth of the house, but in addition the coming worthy of given that business strategy was followed. Sooner, the advantage of a personal financing is the fact that Lender try willing to give a loan besides against the as the-try value of, as well as understands that whether your organized improvements try done, tomorrow worthy of was higher so that they are willing to believe one also.

What exactly is antique investment?

Traditional Finance, such as those offered by financial institutions and you may financial businesses, features relatively stringent recommendations, therefore the popularity of these types of capital has actually limits. To help you qualify for the fresh new cheapest money on the market, you can find usually income and borrowing conditions which might be good roadblock for the majority.

As traditional loan providers are typically studying the borrower’s ability to afford the home loan, that have good W-2 income and you may excellent borrowing from the bank are often good pre-necessary many complete-date a home dealers can not bypass. Additionally, really financial institutions provide financing merely against the since the-is value of without any consideration to virtually any structured improvements, that would become something the true estate individual want so you’re able to care about-finance.

Past control, day is actually money and rates is extremely important to track down a great deal less than package. Quite often, conventional loan providers work at sluggish rate whenever granting home financing, that may damage your chance to safe much on a home.

Misunderstandings about private money lenders

The reality is that there clearly was shortly after a negative connotation tied up so you can individual money credit and also the industry’s reputation is associated with highest rates of interest. However, critics neglect many benefits:

- Time-saver: Private lenders can be usually opt for a software within the eight 10 months

- Shorter red-tape: private loan providers commonly required to stay glued to laws created by the 2010 Dodd-Honest Work, getting individuals a less complicated loan application process

- Value: conventional loan providers need certainly to base money with the property’s appraised really worth (LTV) when you’re personal lenders base its funds towards property’s immediately after resolve really worth (ARV). And work out personal lending a highly attractive selection for a house systems you to cover developments

Be sure to do your individual due diligence for the the lenders to ensure they are reliable. Looking for a personal loan provider to generate a love having is an important the answer to possible investment triumph.

Given that you will find http://www.elitecashadvance.com/personal-loans-wv a general comprehension of funding options, let’s glance at the summary regarding a personal currency mortgage instead of a traditional mortgage.

For example, what if you might be a bona fide property buyer who’s found an effective possessions for the a famous society in need of specific improvements. You determined you should buy the home to own $600,000, spend $two hundred,000 to redesign immediately after which bring in $step 1,000,000. It’s a good package now you simply need currency to make it happen!

If you decided to safe a conventional financing that doesn’t give power to your the fresh new rehabilitation, which needs a good 20% down-payment into the pick, you would need to possess $320,000 bucks ($120,000 get cash + $two hundred,000 on redesign) together with the lenders $480,000 loan. Shortly after a lengthy process of taking W-2 money, monetary comments and a lot more to prove you can afford the mortgage (even though you anticipate attempting to sell the house or property quickly), your qualify for the loan and have started. At the end of 6 months, your sell our home getting $1,000,000 which have a gross earnings from $2 hundred,000 and you can a web funds of $179,740. Pretty good! Merely remember that that it conventional financing requires $320,000 guarantee is put into the deal.

Let’s see just what this contract would seem like if the working with a private money-lender. Given that individual loan providers check out the upcoming value of a property and you may bring financing up against it, which loan is sold with an even more manageable $120,000 equity specifications as they begin to lend you 100% of one’s renovate budget. It can save you big date whilst plays average 10 weeks for one determine if you may be recognized and possess started on your own redesign. Your panels is fully gone, therefore offer the house getting $1,000,000 having a gross money away from $two hundred,000 and you will an online money from $159,2 hundred. Unbelievable!

At the end of the day, when you have a look at how much money you have made, the standard loan wins since it came with a diminished appeal speed.

However, a savvy investor can look at what kind of cash you’d to spend making that money (the money-on-cash return). Following that possible easily see that the cash-on-money back to your personal money mortgage is over twice and substantiated that from a good investment perspective. Personal money also have buyers greatest cash on bucks output than traditional currency one day of brand new day.