- October 23, 2024

- Posted by: Visa Imigration

- Category: cash advance no credit check no bank account

This new Virtual assistant appraisal declaration boasts reveal studies of your own property’s well worth, position, and you will compliance towards the VA’s Minimal Property Criteria (MPRs). The fresh report is prepared by the Va-recognized appraiser and you will published to the lender to possess review.

Possessions Characteristics: The fresh new declaration commonly notice the number of rooms and you may restrooms, the type of design, in addition to property’s overall status.

Value of: This new appraiser establishes the newest property’s worth based on numerous affairs, plus current comparable sales in the area, the newest property’s location, additionally the property’s position.

Lowest Assets Conditions: The fresh appraiser often examine to be sure the house or property matches this new VA’s Lowest Property Conditions (MPRs), which includes situations such as for instance architectural integrity, safeguards, and you will practices.

Fixes otherwise Deficiencies: Or no solutions or inadequacies are observed, the brand new appraiser commonly notice all of them on the report, including an estimated rates to solve all of them.

Photos: New declaration will include photographs of your own property’s indoor and you may outside to incorporate a graphic number of your appraiser’s examination.

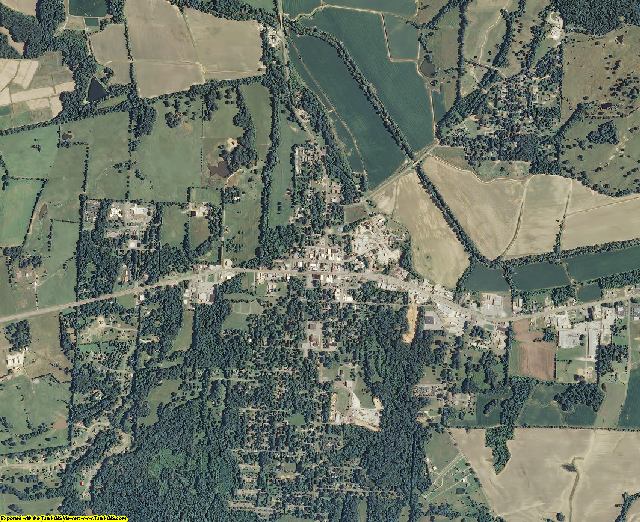

The fresh appraisal declaration cash advance locations in Fulton AL are a critical document from the Va loan processes since it support the lending company determine if the house or property is suitable for a great Va financing assuming the borrowed funds number was appropriate for the fresh new property’s really worth.

The length of time it will require for new assessment declaration

Brand new timeline having choosing brand new Va appraisal report can differ situated towards numerous factors, like the workload of your own appraiser as well as the difficulty regarding the house.

But not, typically, they usually takes on 7-ten business days towards the financial to receive the newest assessment declaration following appraiser completes the brand new evaluation.

Oftentimes, it might take offered if the you will find people circumstances otherwise discrepancies that need to be handled. The latest debtor is consult a copy of one’s appraisal declaration off the lender just after it is received.

Just how long are Virtual assistant appraisal good

A beneficial Va assessment is usually appropriate to possess half a year on the go out of appraisal. However, in the event that there have been changes into the assets or perhaps the market as appraisal is actually done, a different sort of appraisal may be required. At exactly the same time, whether your loan isnt signed in half dozen-day legitimacy several months, brand new assessment must become current or a unique assessment purchased. It is vital to work with your bank so your own Va assessment is true or over-to-go out regarding loan techniques.

Who will pay for Va assessment

The cost of the latest Virtual assistant assessment is generally paid for by the the latest borrower as part of the settlement costs. But not, the financial institution get let the borrower to add brand new assessment payment throughout the complete amount borrowed, and thus it might be paid down over the direction of mortgage. While doing so, the vendor should purchase the fresh new appraisal as a key part of its sum for the settlement costs, but it must be decideded upon because of the all the activities involved in the order.

In the event your Virtual assistant assessment will come in below asked, it can carry out specific pressures at your home to buy techniques. Check out things to do in such a circumstance:

- Comment the fresh appraisal statement: Glance at the assessment declaration in detail so that around was in fact no problems made by the appraiser. Find out if the contract details towards assets is actually accurate, including the rectangular footage, level of bed rooms and you can bathrooms, and you may one updates otherwise home improvements.

- Renegotiate the price: In case the assessment is gloomier than the price, you could potentially ask the seller to lessen the cost to fit the assessment really worth. That’s where which have a realtor would be beneficial for the discussing in your stead.