- November 6, 2024

- Posted by: Visa Imigration

- Category: cash advance what is

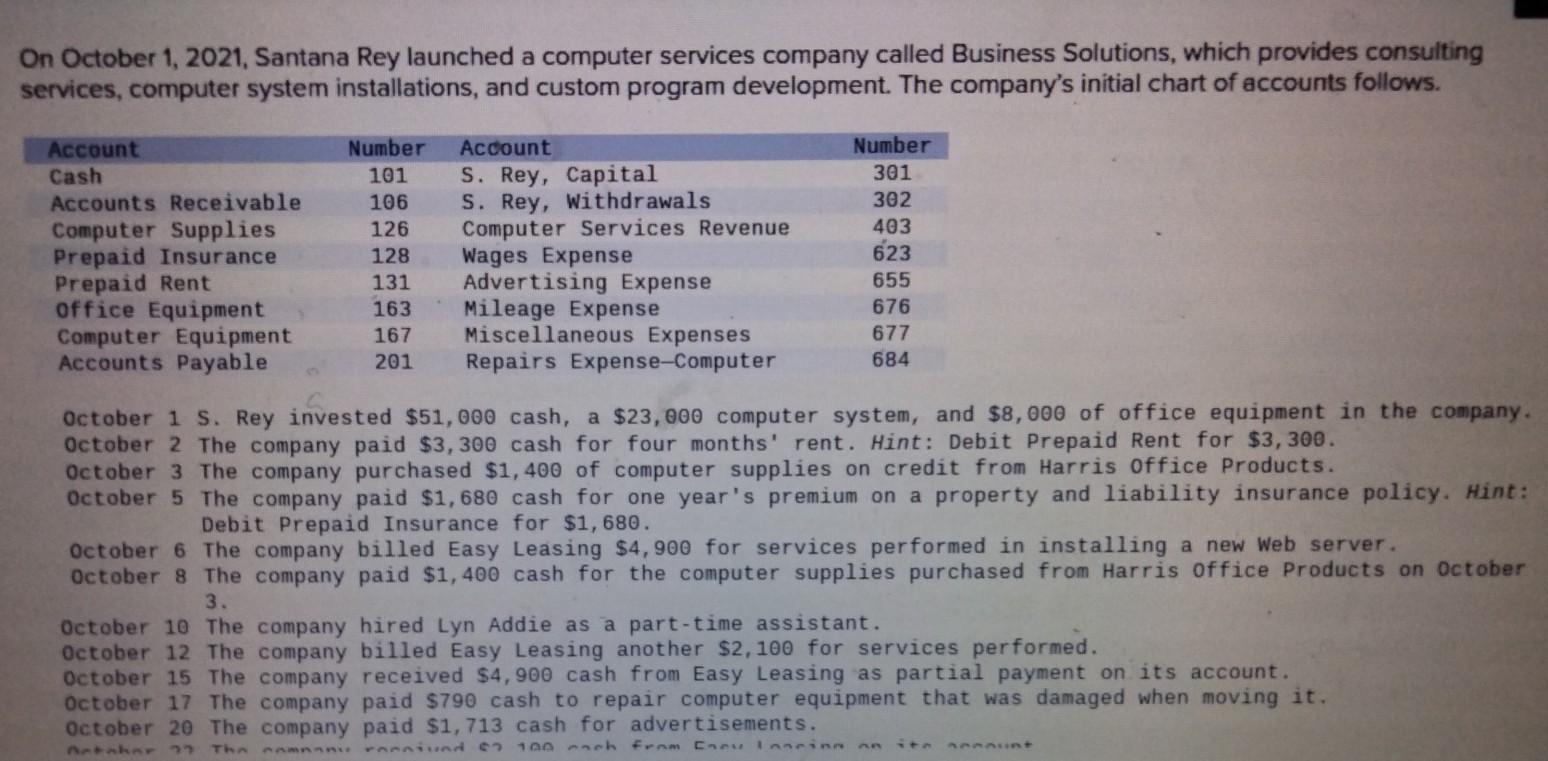

Buying a property is actually a tense months within the anyone’s lifetime. Towards the top of a number of things to do, try securing a mortgage. This is certainly specifically hard for those who works stressful otherwise hard procedures such as nurses. With the extended hours and hard works, trying to find time to safer home financing are an even more hard disease. Luckily, for those moving to the state of Texas there are several selection that can assist result in the procedure much easier and you can smaller. Let us examine a few of the alternatives for taking home loans having nurses in the Texas.

Colorado County Sensible Homes Agency (TSAHC)

The original providers to remember is the Tx County Affordable Property Firm, or the TSAHC. This is exactly a low-funds which was developed to incorporate help in securing homes having reasonable to help you modest income family. And also, nonetheless they Windsor installment loans no bank account promote some most help for all those in a number of professions instance breastfeeding.

For more information, listed below are some their website. He’s many info on all the different software they give you, as well as info on qualification and requires. He or she is an important funding, and will be a key get in touch with within the whole process.

Land To possess Tx Heroes

The major system interesting getting home loans having nurses within the Tx is the Belongings To own Tx Heroes. This option will bring downpayment assistance and low interest rates financing solutions getting Tx Heroes, which of course boasts nurses.

First off, they offer deposit features regarding step 3-5% for people who be considered. It is vital to understand that this help is an offer, meaning it doesn’t need to be paid down. This is certainly a very glamorous work with that every whom qualify is always to naturally take advantage of.

Upcoming, the money safeguarded by this program plus typically have a reduced interest than many other options. Even a small improvement in attention can help to save a debtor plenty along side longevity of the mortgage. Those two masters really can sound right, and create an effective possible opportunity to safe a good reasonable home loan.

Who Qualifies To have Guidelines?

To possess medical, provided are Allied Health professors and also other nursing team instance college or university nurses. Together with, crisis solution personnel are in addition to eligible. For more for the eligibility by the industry, have a look at TSAHC web site.

In addition to the program requirements, the individual loan providers giving the fresh loans may also have the individual criteria. This might tend to be particular income otherwise credit rating conditions. Be sure to inquire a possible bank about their eligibility standards.

How will you Rating that loan?

All the funds are offered of the recognized third-party loan providers. To be had from the a third party, per loan could have its very own conditions and terms that vary by the bank. This may mean an improvement in interest including, thus make sure to check around to find the best bargain.

An informed first faltering step is to obtain in contact with the fresh new TSAHC. It not only features a list of recognized lenders, but may also help potential individuals for the mortgage procedure. They should be the initial get in touch with part when it comes down to prospective individuals!

Mortgage Borrowing from the bank Certificate (MCC)

Another great benefit first-time home buyers inside the Colorado get ‘s the Home loan Credit Certification (MCC). This might be a tax borrowing predicated on desire paid back on an excellent home loan that will return doing $dos,000 a year towards homeowner.

Keep in mind even if, this might be simply accessible to first time residents. New TSAHC talks of it since the a person who since the perhaps not had an excellent domestic prior to now 3 years. While you are a little while restricted, it is a very attractive extra to people that qualify, and helps to make the first time property procedure less expensive.

Most other Home loan Selection

For people who cannot qualify for the home To possess Texas Heroes system there are many more selection. Others fundamental program offered by the fresh new TSAHC ‘s the Household Sweet Colorado Home loan.

So it mortgage was created to assist reasonable to help you reasonable earnings household and individuals and get a mortgage. This are available to nurses, it is along with accessible to some other disciplines you to definitely satisfy specific money standards. For those that never be eligible for the fresh Heroes system, it is a good last option.

Could you be a veteran? Take a look at our very own Virtual assistant Mortgage from inside the Colorado blog post right here to see exactly how Va financing could help!

Home loans To possess Nurses Into the Texas

As the a nursing assistant lifestyle or thinking of moving Texas discover numerous high choices to help on the way to owning a home. Brand new TSAHC brings several higher programs to help aside those in the fresh medical industry, and ultizing them can help make the entire process simpler. Knowledge this type of available possibilities is important of getting a knowledgeable household loan!

Exactly what Assistance is Designed for Nurses?

The 2 fundamental software are definitely the Texas Heroes and you can MCC tax borrowing from the bank. This new Texas Heroes applications provides grants having nurses to purchase home and loan attention funds. The new MCC income tax borrowing from the bank helps counterbalance appeal reduced into the a home loan, but is offered to very first time home buyers simply.

Towards Tx Heroes offer no, but also for brand new MCC tax borrowing from the bank sure. The MCC taxation credit is a wonderful very first time household consumer system getting nurses.

Yes, new Colorado Heroes system also offers downpayment guidelines regarding function off gives of up to step three-5%. This help is a grant and will not must be paid!

Leslie Rowberry

Leslie Rowberry try an interest rate Secretary and you may Realtor with over fourteen numerous years of training and you can 12 years of feel in various sectors of your industry. The woman is an expert in assisting somebody get, sell, otherwise lease property, together with which have an in-breadth understanding of borrowing, various financing products available in the us from The united states, as well as most other areas of your house to find processes.