- December 9, 2024

- Posted by: Visa Imigration

- Category: payday loans bad credit loans and cash advance loans

Regardless if you are a primary-day domestic buyer or given attempting to sell your existing the place to find purchase a different sort of that, it’s also possible to question just how much house you could logically pay for. Let’s perform some mathematics to you personally. Enter into debt info, including income and you can expenses, towards our home cost calculator observe how much household your you will squeeze into your financial budget.

Just what Necessary for The Calculator

- Yearly family earnings. It’s your overall yearly domestic income before fees and you may deductions.

- Monthly financial obligation. Total up your monthly minimum repayments for all the bills, including playing cards, unsecured loans and you can student education loans. That it contour is used to help you determine the back-prevent debt-to-money ratio. The lower your own DTI ratio, the more room you really have on your finances.

- Downpayment. Here is the amount you intend to expend upfront to buy a house. Increased deposit helps you safe less interest price. For the a normal loan, a deposit with a minimum of 20% of your own purchase price enables you to stop purchasing private financial insurance. How much cash you could potentially set on the a downpayment also get determine which mortgage products you can be eligible for.

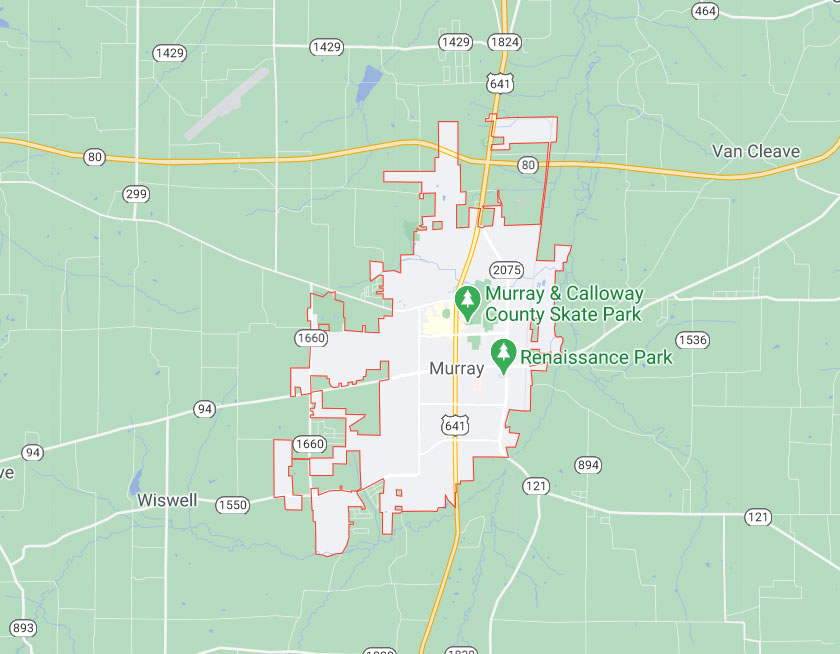

- Condition. Entering the county in which you anticipate to get a home lets the calculator guess your house taxes.

- Interest. This is actually the interest rate you expect to invest toward financing. You might enter the economy rates into the variety of loan you expect to get, or you can get into a specific rates when you yourself have an excellent home loan preapproval or a rate lock to your a loan provide.

- Possessions tax speed. That is prefilled according to research by the condition what your location is trying to buy a home. The total amount you can expect to spend from inside the property taxation is actually included in the monthly payment description.

A whole lot more Solutions

- Mortgage name. The length of time you will take to pay your own mortgage, usually fifteen or three decades.

- PMI. Estimated fee every month for individual home loan insurance. You only pay PMI in case your down payment is actually below 20% towards a conventional financing. If that applies to you, go into the quantity of PMI you expect to spend, that is usually $30 in order to $70 a month for every $100,000 borrowed.

- HOA charge. Whether your household you will be buying belongs to a residents organization, you’ll want to spend monthly expenses.

- Home insurance. Mortgage brokers want borrowers to possess homeowners insurance. When you yourself have a quote otherwise quote on insurance rates when you look at the the bedroom you are looking to purchase, installment loans online in Idaho you can enter the month-to-month costs.

How Calculator Work

By using the guidance you go into, the fresh new calculator prices the cost of our home you could manage to get, starting with an excellent 36% DTI ratio. Adjusting this new slider changes just how much monthly earnings you happen to be putting to your the mortgage payment and you will modifies our home rate you could potentially pay for. It assists you have decided if or not purchasing just about a month into the a house would match conveniently to your finances.

Just how Money Facilitate Determine how Much Household You really can afford

Whether or not you have made a yearly income, each hour wages, profits or investment earnings, or was thinking-operating otherwise a regular staff, exactly how much domestic you really can afford will be based in your annual gross income. Your own financial will require proof your revenue over the past two years to be certain it’s uniform and you will alternative.

Isolating their annual gross income because of the a dozen works out the gross monthly earnings, and this loan providers used to decide how much you really can afford for a monthly mortgage repayment.

The Rule

Extremely lenders calculate their DTI percentages thereby applying what is called the new signal. That it general guideline means that: