- January 8, 2025

- Posted by: Visa Imigration

- Category: how much is a payday loan

A fund contingency try a condition that allows the brand new termination out-of product sales price in place of punishment while you are struggling to safe financial support toward family. You can aquire preapproved to track down property financing that have crappy credit, nevertheless might get lower than the imagine. While the terrible area would be the fact your credit score will go down immediately following it’s featured!

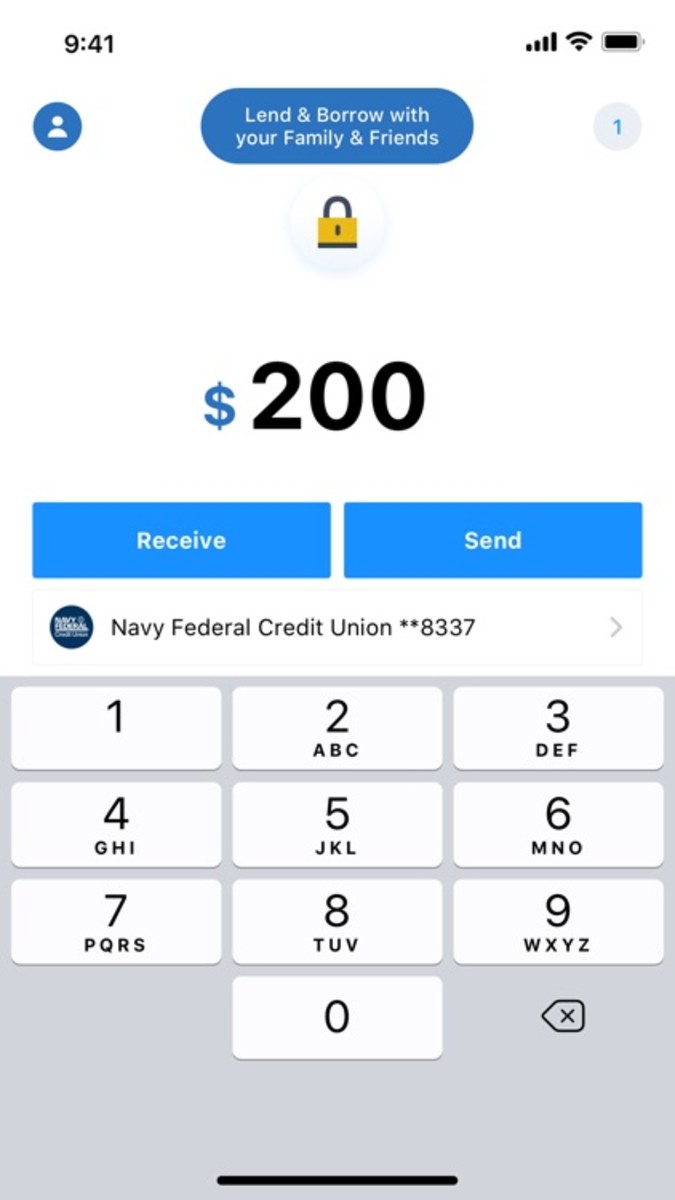

Assume you get preapproval of a lender getting a good $200,000 mortgage. When you give even more income documentation, the borrowed funds financial may only give $150,000. A fund contingency makes you cancel this new deal nonetheless discover the serious money put.

Customer’s Inspection Backup

There is no need to do a home inspection prior to making a purchase provide, but it’s in your best interest getting one. Thorough home inspections will help uncover unseen factors and you can lifestyle-threatening difficulties with the real house possessions. Knowing truthfully what exactly is completely wrong on the family makes it possible to pick in the event your financial support deserves they.

A check contingency standards the brand new closure techniques to the consumer’s fulfillment towards the inspection reports. An assessment backup condition enables you to money that or several inspection reports from inside the review months. In case your inspector finds out a serious defect, you could negotiate towards vendor otherwise cancel the acquisition contract. Throughout the transactions loans in Sylvan Springs, you could potentially consult solutions or a price reduction with the list rates.

Insurance Backup

Possible buyers can also add an insurance coverage backup clause to get deals. Certain claims are susceptible to disasters, meaning that of numerous insurance companies doesn’t bring visibility. An insurance coverage contingency makes you terminate the brand new bargain if you can’t get recognition for homeowners’ insurance policies. You may also pick a house within the Ca, however, on account of fireplaces, earthquakes, and you may drought, you may have complications providing homeowners’ insurance that have an acceptable rules.

Assessment Contingency

During the acceptance processes for a mortgage, the financial institution get publish an appraiser to evaluate the home and you will determine industry well worth. The new appraised worthy of is lower than brand new number price of the house need. If so, the lender ple, you will need an excellent $350,000 financing purchasing a pleasant farmhouse, however the appraisal shows your house is truly well worth $2 hundred,000. An appraisal backup handles you from to buy a house really worth shorter than you’ll pay.

Should i Waive a home loan Contingency?

Once the a buyer, you’ve got the capability to waive a minumum of one financial contingencies in the home-to acquire procedure. Setting-up a mortgage contingency normally complicate the house-to purchase processes and take a lot more date. Yet not, home loan contingencies provide consumers monetary coverage during the a property transaction. Removing a loan backup setting youre forgoing a safety net.

The advantage of waiving a home loan contingency is that you may profit a putting in a bid battle and you can reduce your house to buy processes. When the a vendor desires promote rapidly, they could choose to work with a buyer ready to speed in the family-to acquire processes. Including, waiving an assessment contingency is fantastic for the seller! In case of a decreased assessment, the seller shouldn’t have to renegotiate product sales rates or select an alternative consumer prepared to spend the money for list speed. After you waive the fresh appraisal backup, you have got an increased chance of winning within the a multiple-provide situation.

A house purchases contingency stipulates your client’s house have to be ended up selling before you buy a new that. Waiving a property product sales contingency is practical if you are to invest in assets the very first time and don’t require funds from attempting to sell a previous home. Of several suppliers see house revenue contingencies unsightly because they subsequent complicate the brand new closure techniques. If you don’t become a house sales contingency clause, but a different consumer does, your own promote will get recognized.