- January 31, 2025

- Posted by: Visa Imigration

- Category: payday loan on

While you are to order a property for the first time, there are plenty things you need to understand – and lots of things dont find out about until the most cost is actually installing up for grabs available.

Some thing rating even trickier when you are an initial-go out domestic customer . However, there are many regulators software built to help basic-big date home buyers, not one of them in fact help you include disregard the through house insurance rates.

Home loan company criteria is somewhat tight (and you will sometime foggy) based on how much you place down on your home, simply how much security you have in it and amount the latest lender still has dedicated to they.

While making some thing a tad bit more clear to you personally, here are some these types of around three home loan company conditions to own home insurance and you can even more things you need to know since a resident who having a home loan.

Zero, homeowners insurance is not included in the mortgage. Yet not, you may be in a position to pay your own home insurance premiums owing to your own mortgage by way of something called impounding.

It is a free account put up by your lending company you to guarantees people (and frequently flooding) insurance policy is repaid on time each month. Home loan people usually deflect so it account to people who establish lower than 20% on their domestic.

Bank Criteria to have Home insurance

When you have home financing on the home (definition you’ve not paid back your house completely), you have to enjoys home insurance. Because the lender commercially still has money in house with mortgage loans, they would like to make certain that their investment is actually fully covered in matter-of a disastrous danger.

step one. Maintaining Minimal Publicity

Imagine if you purchase a home having $250,000 and also you lay $twenty five,000 down. Lenders will need one enjoys at the very least $225,000 in hold exposure . not, we usually recommend so that the full value of your house ($250,000) and even even more.

Loan providers including only need one to manage exposure for their bit of home loan, and not your own. That is because should your home were to feel completely shed by a shielded peril while still owed money on the house, they wouldn’t cure all the money it loaned you. Lenders you are going to nonetheless get their cash return via an insurance claim.

Whenever you are house coverage is the just form of homeowners insurance that is officially necessary for loan providers (because they do not keeps a financial investment in your individual land, pets otherwise other things that will can be found on your property), i along with strongly recommend bringing full dental coverage plans.

This will be almost really the only coverage you could get, however, we nonetheless have to harp on significance of maintaining enough publicity for all areas of your daily life. Furthermore really worth detailing you to definitely loan providers commonly do not require you to have replacement for pricing exposure , but it is a wise idea to do so.

dos. More Requisite Exposure

Not guaranteeing the property could be far too risky for them, so they need to ensure its capital is covered significantly less than most of the facts installment loans in Virginia. That is plus as to why lenders want ton insurance out-of property owners just who have not paid off the borrowed funds.

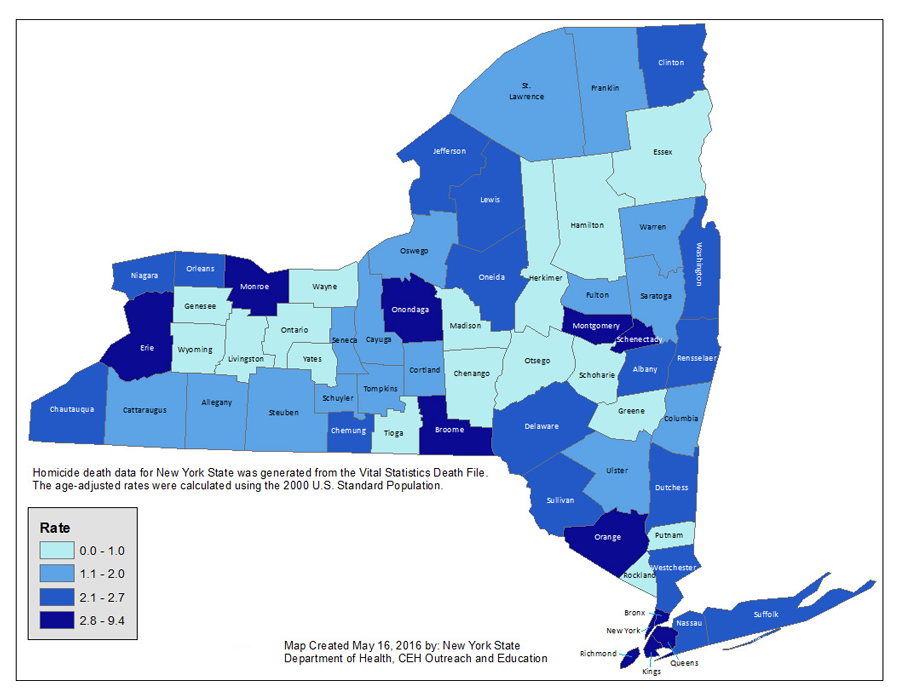

An equivalent can be said for these mortgagees who happen to live inside a quake-vulnerable urban area. The individuals anyone need to maintain sufficient disturbance exposure while they are however investing off their mortgage. Individuals who inhabit a wildfire-prone region can certainly be needed to maintain sufficient wildfire insurance coverage too.

step three. Loss Payee Criteria

When you take care of home financing, their lender might want to include all of them just like the a loss of profits payee (plus yourself and you will anyone else towards home loan). It guarantees they get money even in the event a property owners insurance coverage allege are registered.

Home loan Insurance coverage versus Homeowners insurance

Basically, homeowners insurance talks about the dwelling of the property, structures attached to they, your own homes and you can any medical costs otherwise attorney fees in the event that somebody was harmed on your property. Personal financial insurance policies (PMI) really helps to refund the financial institution should you prevent and come up with payments on the mortgage.

PMI is only needed in old-fashioned loans if the down-payment is below 20 percent or you happen to be refinancing that have lower than 20% collateral at your home.

Since a citizen that have a mortgage, the financial institution however keeps guarantee in your home and requires to include their funding, it is therefore imperative to know precisely what you want – and you may what you don’t!

I mate to your state’s better home insurance enterprises so you could possibly get a customized coverage at a reasonable cost.