- December 18, 2024

- Posted by: Visa Imigration

- Category: payday loans with bad credit near me

There are unique considerations to trust over whenever you are looking to combine obligations around the same day you purchase property. Hold the following the factors at heart:

- Check your credit history: Checking your credit rating to see where you are might help your determine whether you can be eligible for a debt settlement loan towards most useful cost and you will conditions available today.

- Get pre-qualified: Extremely companies that provide signature loans to have debt consolidation reduction enable you to “look at the rates” and see offered monthly obligations and you may loan terminology before you apply.

- Find out the old versus. brand new payment: Once you’ve a concept of exactly what your payment per month you may getting with a debt negotiation mortgage, you could potentially contrast one to total what you’re currently paying with the credit card debt or any other expense.

- Dictate your DTI: Make sense all monthly debt costs, determine your month-to-month revenues, and you may manage the brand new numbers to determine your DTI. See if your own DTI drops within the range discover acknowledged getting a mortgage after you combine.

Sorts of Debt consolidation and Home loan Ramifications

When you are probably one of the most well-known different debt consolidation is actually a personal repayment loan, there are many online payday loans Weogufka AL more version of loans that can work with this objective. Think how each type out of debt consolidation reduction financing you are going to impact your power to get approved getting a mortgage.

Consumer loan

Personal repayment fund incorporate fixed rates, repaired monthly premiums, and a flat payment name that will not changes. Even as we mentioned currently, getting a lesser monthly payment toward an obligations combination mortgage is lower your DTI and work out they simpler to be eligible for home financing. Yet not, the exact opposite is additionally genuine, and a debt negotiation loan having a high payment you are going to create qualifying much harder.

Harmony Transfer

Balance import playing cards bring a good 0% annual percentage rate (APR) on transfers of balance (and frequently orders) for as much as 21 months, even in the event harmony import charge use. Animated loans to a different credit card who may have zero attention should decrease your credit application ratio straight away, as your the fresh new commission was far lower as a result of the not enough notice. However, you really need to keep dated charge card levels discover which have a great $0 balance to keep your credit utilization proportion as low as possible.

House Security Mortgage

For folks who currently own a home and just have significant security, you can look at borrowing money for debt consolidation which have a house collateral mortgage using your house once the equity. Remember you to definitely particular lenders will simply allow you to obtain upwards in order to 85% of your home’s well worth round the all lenders you really have, like the top financial and domestic security mortgage circumstances.

Recommendations to own Debt consolidating and Financial Management

Managing the money toward a home loan, a debt consolidation mortgage, and just about every other bills you have to pay might be challenging, but you’ll find things you can do to help make the techniques much easier. The following advice helps you keep the money and increase your credit rating throughout the years.

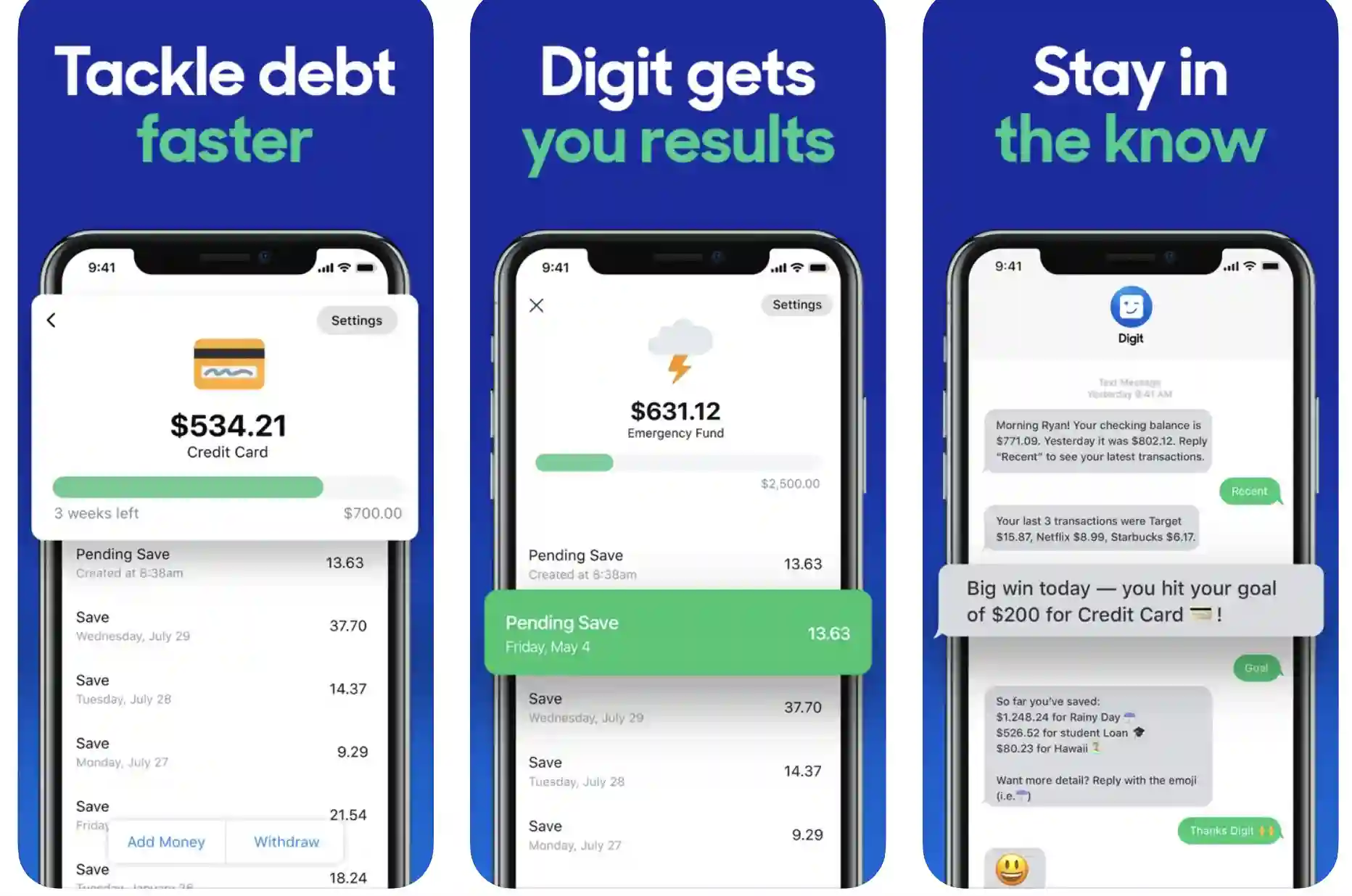

- Begin using a composed monthly funds: Individuals need prevent the overspending that had all of them into obligations before everything else, and an authored monthly finances may help. In place of recording all your expenses and you may costs for each and every times that have pencil and you may paper, you can play with various cost management apps so you’re able to song the expenses and construct an idea for cash you secure.

- Pay-all the debts very early or timely: Because your percentage records is an essential component that renders up your credit score, and also make every costs costs promptly (or prior to, if feasible) is vital. You are able to thought setting-up a few of your own expense for automatic payments when you are afraid you can easily forget about.