- December 22, 2024

- Posted by: Visa Imigration

- Category: payday loans and how they work

No Comments

Conclusion At the start

- Making smart money behavior now such as for instance cost management, setting up an urgent situation money and you can building your own borrowing from the bank will help you to generate a more powerful monetary upcoming post-graduation.

- In time to your benefit since an early professional, you might be during the a great set for people who start believed for your retirement now.

For you personally to Discover

Great job, graduate! Since college or university is more than, you will be doing an exciting the fresh chapter full of solutions and you can unknowns-many of which you can expect to feeling you financially.

- Know where you stand financially. Your life style and working situations likely have altered once the graduating regarding college, and therefore may have a big influence on finances. Determine your budget of the subtracting your own month-to-month expenses from your own money. Make sure you take time to reason for one education loan payments.

- Stick to your budget. Becoming into finances-if not better, not as much as budget-normally make sure your economic requirements stay attainable. Stop a lot of debt and build a crisis fund into the funds. Check if you happen to be getting to your address of the seeing the borrowing from the bank otherwise debit credit stability have a tendency to.

- End up being wise having living expenses. Instead of blowing your budget to the best place you is also come across, imagine a more healthy method. Unlock the head to less costly communities and do not rule out living with roommates, sometimes. So you’re able to round anything away, restrict the newest instructions.

- Make the most of employee benefits. Masters is the best friend. They offset insurance premiums that assist it can save you having later years, among other things. On senior years side, of many employers give coordinating contributions in order to a tax-advantaged old age account. In case your boss now offers it brighten, attempt to lead around you could to earn the complete fits. You might boost your share a portion or even more on a yearly basis to keep broadening your own deals. You’ll be able to be offered health insurance, short- and/or much time-name disability insurance coverage or coverage at attractive classification rates. It’s also possible to help save to own retirement on your own that have an excellent Antique otherwise Roth IRA.

- Invest in your job. When you need to homes a better job or bigger income, you will need to remain committing to your self. Network with others by the signing up for an expert providers and you can browsing advancement and you will education occurrences. You can even grab kinds to compliment your talent. Consider free otherwise cheap programs that would be available or through people training.

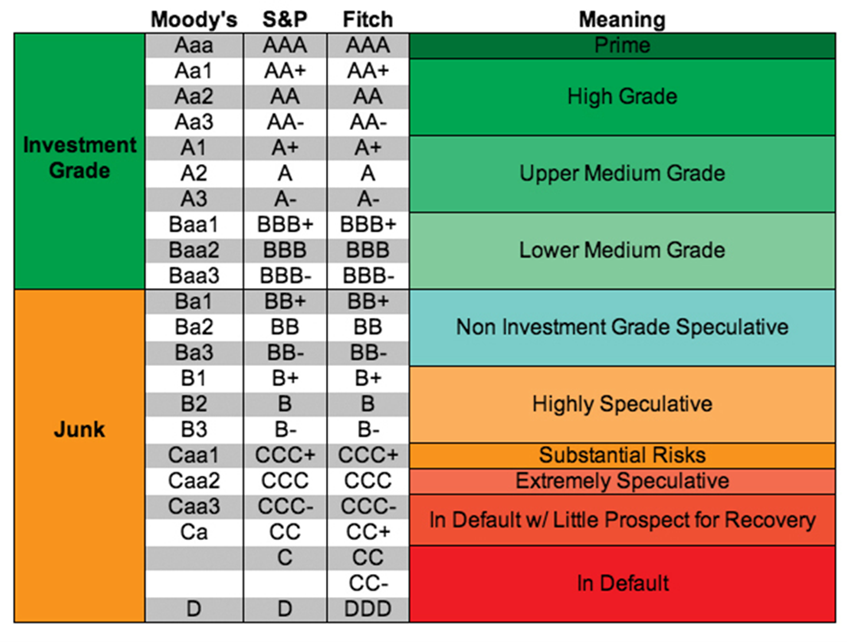

- Build borrowing. With a good credit history makes it possible to be eligible for funds, handmade cards plus leases. You can make credit by paying debts promptly, each and every time. To keep your score solid, stop opening too many mortgage otherwise borrowing from the bank membership inside a preliminary several months, endeavor to only use doing 30 % of your own complete borrowing limit, and you can wait on closure old mastercard account, once the period of your credit report can impact your own rating, as well.

- Look into paying off highest-appeal debt very first. Student education loans make up the most significant category of debt for some previous grads. Should you too enjoys credit debt, it’s likely during the a greater rate of interest. Put whenever you into the the better-appeal debt basic, if you find yourself continuing to make minimal money toward almost every other obligations. This may save some costs and allow one pay higher-focus financial obligation quicker, providing you with more money to put into student loan personal debt repayment.

- Envision education loan integration or refinancing.Footnote step one You are capable avoid juggling numerous mortgage costs from the combining several government financing into the one the brand new mortgage. For those who have a mixture of individual and government student education loans, you might refinance them to one another, however you may chance quitting unique benefits associated with the federal loans. Weighing the benefits and you can disadvantages before carefully deciding. Navy Government Borrowing Relationship helps you refinance private student education loans and you may chat using your possibilities.

Getting the https://www.cashadvanceamerica.net/loans/flex-loans/ money in order today will help you started to this new goals as you progress via your profession and you can lives once the an mature. A small work in advance could lead to smart models and huge benefits for future years.