- January 9, 2025

- Posted by: Visa Imigration

- Category: payday loans direct no credit check

Prepared to get your earliest home? Working with limited income or money to have a deposit? An authorities-insured Federal Housing Management (FHA) Financial has been providing somebody pick land while the 1934, and you can Midwest BankCentre is actually pleased giving so it solution to regional citizens.

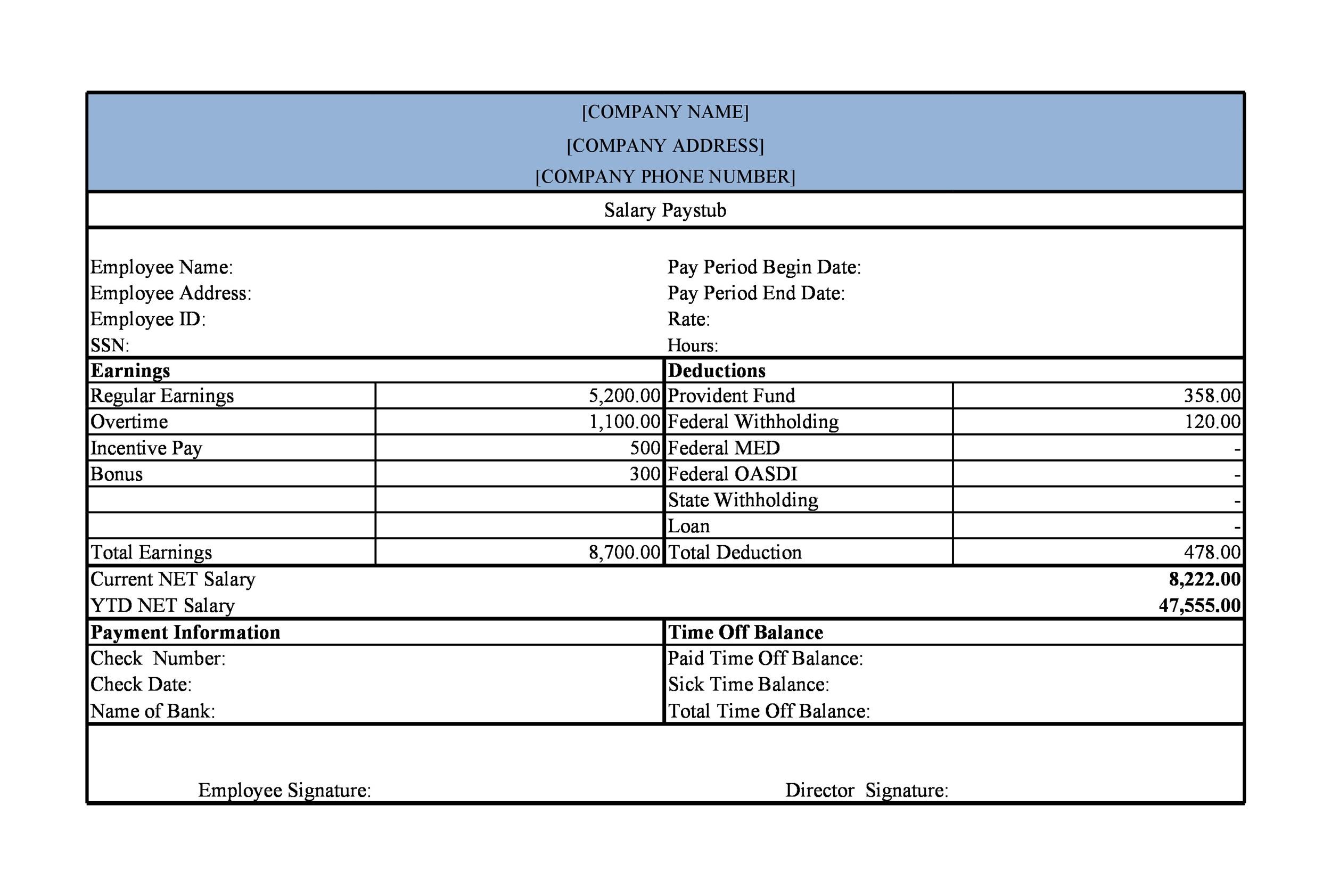

FHA Home loans is mortgages covered by FHA, leading them to even more open to consumers that have lower fico scores and you may downpayment restrictions. So you can be eligible for an enthusiastic FHA Home loan, you ought to meet certain requirements, along with constant employment, and you will a workable personal debt-to-money ratio. While doing so, you’ll need to provide the called for files to show your qualification.

FHA Mortgage conditions.

Whenever trying to get a keen FHA financing, it is very important just remember that , you can find FHA mortgage restrictions considering venue.

You can secure an enthusiastic FHA mortgage that have a beneficial down credit rating than simply a conventional loan, with stricter standards. The minimum rating hinges on the lender otherwise loan manager, enabling way more residents to really have the imagine payday loans Mississippi home ownership. Since there is no lowest requirement, the likelihood of acceptance increase which have a top credit score, in conjunction with earnings and you will a position affairs. FHA home loans have financing restrict that is dependent on the town. More resources for FHA requirements, contact our home loan officers to talk about your specific financial disease.

A selection for very first-go out homebuyers.

FHA Loans are often used to help customers who require the latest chance to place less overall down on a property. By the low down percentage, FHA Financing is beneficial for first-big date homebuyers, plus people who have faster-than-finest borrowing.

FHA individuals pay a monthly top (MIP) similar to mortgage insurance coverage. So it covers the lending company out of losings in the event that a debtor non-payments into the that loan, and you may homebuyers need certainly to show evidence of money so you’re able to qualify.

Midwest BankCentre, a federal Houses Management-recognized financial, has processed FHA finance to have consumers all across the usa. The state of Missouri even offers guidelines apps having first-date homebuyers, and has, financing, down-commission recommendations, and tax credit. Help our professionals make it easier to through the procedure.

The Faq’s protection very important details particularly qualification requirements, downpayment criteria, mortgage constraints, and. Whether you’re fresh to your house to shop for procedure otherwise seeking re-finance, we are here to help you know the way FHA finance can perhaps work for you. If you have even more questions otherwise you need recommendations, the mortgage experts are prepared to help.

One another choice give you the exact same rate of interest stability, however the 15-year title features high monthly installments, providing a more quickly treatment for build home guarantee. You can utilize that it large collateral since the a down-payment when your move to your upcoming home. Certain FHA Funds possess loan amount hats and will vary according to venue.

Maximum loan amount getting an FHA Mortgage may vary oriented to your located area of the property. The fresh Federal Casing Management sets financing limits per year, considering local housing market standards. Such limitations typically mirror this new median home values within the for every single city. It is critical to consult a home loan banker or utilize online learning resources to select the particular FHA loan restriction applicable to help you the desired assets place.

FHA Improve refinancing try a basic procedure built to let FHA consumers lose its mortgage repayments and you will rates of interest. The benefits of FHA Smooth refinancing become limited documentation criteria, no assessment requisite, together with power to refinance versus lso are-being qualified to own credit otherwise money. This makes it a convenient choice for individuals who want to make use of lower rates of interest or remove their month-to-month home loan repayments in place of detailed files.

Sure, you can use an enthusiastic FHA 203(k) Rehab Loan to finance the acquisition and you may recovery from an effective fixer-upper assets. That it specialized FHA mortgage program lets individuals to mix the purchase price regarding home purchase and repairs on one financial. It gives funds for both the purchase of the property and you may the fresh restoration work, so it is a stylish selection for those people looking to increase the reputation from a home when you are money they.

Sign up for an enthusiastic FHA Financing today!

Midwest BankCentre was a keen FHA lender and offers FHA Lenders in order to people in the Midwest. All of our financial gurus alive and you may really works right here, causing them to highly always your local housing industry and offering an aggressive mortgage speed. Our company is in a position help you to get a knowledgeable regional FHA mortgage loan for you.