- January 9, 2025

- Posted by: Visa Imigration

- Category: i need a payday loans

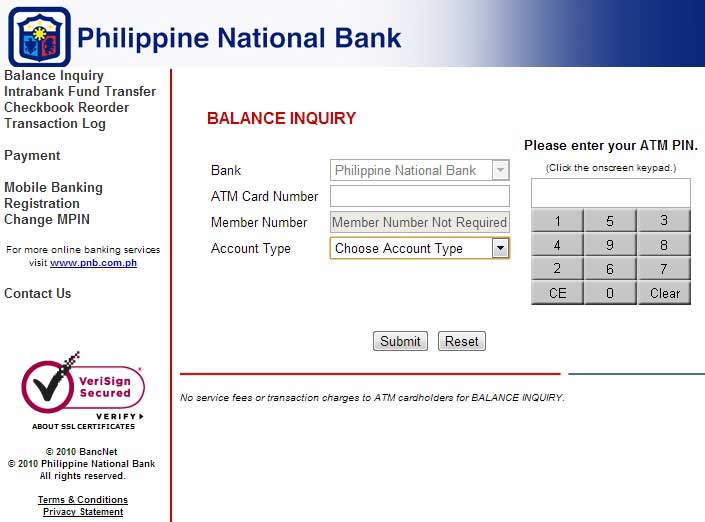

- Render Documents: Complete the mandatory data as well as your app in order to expedite the newest approval processes and make certain compliance with regulatory conditions.

- Fulfill Procedural Standards: Done the proceeding requirements, plus remitting the necessary charges associated with the software procedure.

- Possessions Verification: The lender conducts a comprehensive courtroom and you may technology confirmation of one’s property to assess its compliance with standards and mitigate danger. Courtroom verification involves exploring possession suggestions and you may courtroom files, if you’re technology confirmation assesses architectural balances and you will adherence to help you strengthening rules.

- Financing Sanction Page: Up on effective confirmation, the lender affairs a loan sanction page verifying approval of one’s loan application. Which letter brings assurance of economic support for the get and signifies maturity with the disbursement regarding recognized loans.

- Disbursement from Acknowledged Financing: http://cashadvanceamerica.net/600-dollar-payday-loan/ The latest approved loan amount is paid toward borrower, facilitating the acquisition of the property. Advanced electronic buildings and you may components streamline the disbursement processes, making sure swift accessibility finance and you can showing the brand new lender’s dedication to progressive economic processes and client satisfaction.

FOIR Fixed Responsibility So you can Money Proportion

FOIR is an important metric used by loan providers to check a great borrower’s ability to do additional obligations, particularly when making an application for a mortgage. It’s determined of the separating the entire obligations (including mortgage payments, credit cards, and other monthly expense) because of the terrible monthly earnings.

A lowered FOIR indicates a healthier budget, indicating your debtor enjoys a higher power to would debt responsibly. Lenders tend to see consumers that have lowest FOIR way more favourably because of their lower danger of default, offering greatest loan words eg straight down interest levels or maybe more loan numbers.

CIBIL Score

The newest CIBIL get a lot more than 750 ways an effective borrowing from the bank profile, which boosts the odds of financing approval and will be offering a lot more favourable payment terms and conditions for example all the way down interest levels and you will expanded repayment periods.

Applicant’s Ages

The fresh borrower’s years notably impacts along the borrowed funds payback period, impacting the structure away from Equated Monthly installments (EMIs). Quicker EMIs are designed for more beneficial mortgage repayment, reducing the chance of standard. Borrowers’ many years and you may mortgage period influence their choice.

Young consumers get favor longer tenures so you’re able to line-up with the prolonged performing lifetime, when you are older consumers get decide for smaller tenures so you’re able to correspond that have senior years plans.

Increasing your likelihood of getting home financing need appointment every the specified criteria by financial. In that way, you could secure a mortgage with beneficial small print. Here are some procedures to switch the possibility:

A high credit history suggests in charge economic habits and you can enhances the odds of mortgage approval. To increase your own get, focus on and come up with to the-date money, cutting personal credit card debt, diversifying the borrowing portfolio, and seeking advice for update if needed.

The loan app pertains to an extensive comparison of creditworthiness through financial analysis, credit checks, assets assessment, and you will advance payment comment. Recognized individuals found words detailing rates, installment arrangements, and related costs.

Organising their papers ensures effective file administration, conformity with laws, and simple recovery when needed. Categorising individual, legal, and you can monetary facts advances efficiency and helps to control losses.

Diversifying your income sources can help you go economic wants because of the distribute exposure, strengthening strength, and you may promoting inactive earnings. With numerous income avenues enables maximising profits, adapting to offer transform, and achieving financial balance.

As well as a beneficial co-applicant of your property loan application significantly increases approval possibility because of the reducing the economic load on one applicant and strengthening this new complete app.

Examine other loan providers predicated on rates of interest, charge, terms and conditions, character, qualifications criteria, and customer benefits. Understanding these details assures a profitable credit sense aligned along with your requires and you will requires.