- September 21, 2024

- Posted by: Visa Imigration

- Category: paydayloansconnecticut.com+guilford-center cash to go and advance america

A hard Limitation

Credit scores that are ascending in tandem that have tuition will cost you and you may college student loans levels advise that borrowers have discovered a way to create ends up satisfy, probably on the back of rising revenues . But financial obligation membership can only just get so high ahead of they begin delivering a cost with the consumers – specifically those borrowers set-to take on a lot more obligations from inside the acquisition purchasing property. Will eventually, there isn’t any much more relocate place in the a beneficial household’s funds, and you may profit is pressed against the difficult restriction of financial obligation-to-income rates.

The new DTI math is fairly straightforward: If a debtor keeps month-to-month income of $5,000, as well as their month-to-month debt burden (credit cards, vehicle repayments, college student financial obligation an such like.) complete $1,100000, next the DTI is actually 20% ($step 1,100000 monthly loans percentage is actually 20% regarding $5,000 overall earnings). Quite often, the greatest DTI a borrower can have and still get an effective certified financial are 43% to possess funds underwritten because of the Government Casing Government, or thirty six% for most old-fashioned mortgages .

Nevertheless the 43% and you may thirty-six% profile mirror total financial obligation, including pending home loan debt – and since a mortgage may be brand new single-biggest mortgage the majority of people often apply for, financial personal debt understandably is a significant component of full DTI. The greatest allowable DTI having mortgage-associated costs by yourself (and additionally dominant, notice, homeowners insurance, property taxes and personal mortgage insurance coverage money in which applicable) are 31% to have good FHA mortgage and you will twenty-eight% having a traditional mortgage. In order scholar financial obligation develops and you can signifies a more impressive express out of households’ full loans, the level of remaining wiggle room to include when you look at the nice mortgage obligations whilst still being remain within appropriate DTI requirements shrinks.

Maybe not So it’s Work

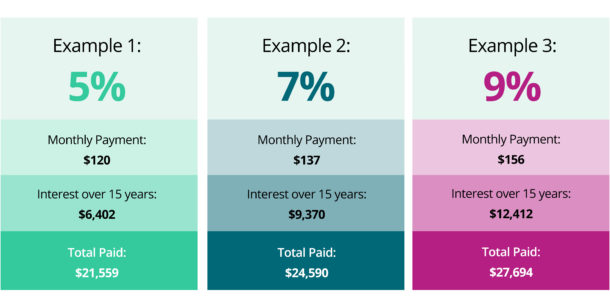

Believe a prospective house visitors one attended school, is during their perfect household-to get decades and is likely paying off figuratively speaking. Guess their younger home brings in the latest 2019 median earnings to have potential people out-of $sixty,100000, which can be responsible for the average 2019 full pupil obligations regarding $thirty-five,205 (Note: https://paydayloansconnecticut.com/guilford-center/ The newest $thirty five,205 average beginner debt burden inside 2019 is quite alongside the brand new $thirty six,178 overall out of few years away from within the-county university fees away from 2012-2015, considering U.S. Reports ). 5% federal rate of interest to own student consumers (almost certainly an old-fashioned presumption, as a huge portion of college student loans is held by the individual loan providers at the highest rates), the payment could be $. Having $5,100000 when you look at the monthly earnings, this household’s updates DTI – of scholar debt by yourself – is eight.3%.

If it family instructions the common $272,446 You.S. house with a low step 3.5% deposit and you will applies for a 30-season, fixed-price home loan in the current interest rate off 3.17%, their month-to-month homeloan payment is $1,bined, which borrower’s mortgage and you may student loans load might be $step 1,, otherwise 29% of its monthly money. You to definitely will leave all of them with simply $300/month into the breathing space to consider a lot more bills as opposed to exceeding the fresh new thirty-six% conventional loan DTI endurance – decreased, such, to afford the common used car fee out of $397 monthly .

Almost one to-in-10 (9%) almost certainly student borrowers towards the a living-based installment schedule has actually such highest student loan burdens which they come out of your own important DTI construction endurance. That number jumps in order to more fifty percent for these with the the product quality ten-seasons installment track. Having Black colored and you can Latinx property, the fresh new perception is also greater. More than several-thirds (68.7%) away from Black households and you can a lot of Latinx domiciles (52.6%) that probably education loan borrowers most likely spend more than just 28% of its monthly money on homes. Incase their newest houses costs load resided a similar with a great financial since it is actually because a renter, these types of consumers is disqualified from really mortgage loans.