- January 16, 2025

- Posted by: Visa Imigration

- Category: can you get a cash advance from bank

Looking money to have a vehicle will be tricky for those who have a poor credit rating otherwise a primary credit score. Within this weblog, we look closer at the as to why lenders try wary of buyers which have down fico scores and exactly how you should start trying to get financing if you have less credit history.

Straight talk wireless: Providing a car loan Having Bad credit

You might be wondering, Should i rating a car loan that have a beneficial 600 credit history? If you find yourself a perform-be motorist with a reduced credit rating, you may get an unhappy shock after you set out to purchase an automobile. Ahead of giving you a loan, one financial can look at your credit score earliest. If the credit score is on the low front side or the credit history is actually short, it will probably be much harder to getting financing.

Thus can there be nothing due to the fact a 600 credit rating car loan? Sure, but it’s attending incorporate certain severe chain attached, particularly a higher rate of interest, an exceptionally a lot of time commission several months, or necessary balloon money you must make so you can catch-up towards the money.

https://paydayloansconnecticut.com/redding-center/

The lower Credit score Enjoy

Whenever lenders provide money getting auto financing, he could be generally buying the auto for your requirements on the expertise you will pay them the money straight back -as well as desire-through the years. To take action, lenders need to be happy to trust that you’re going to arise on cash week immediately after week up to the loan is actually paid off.

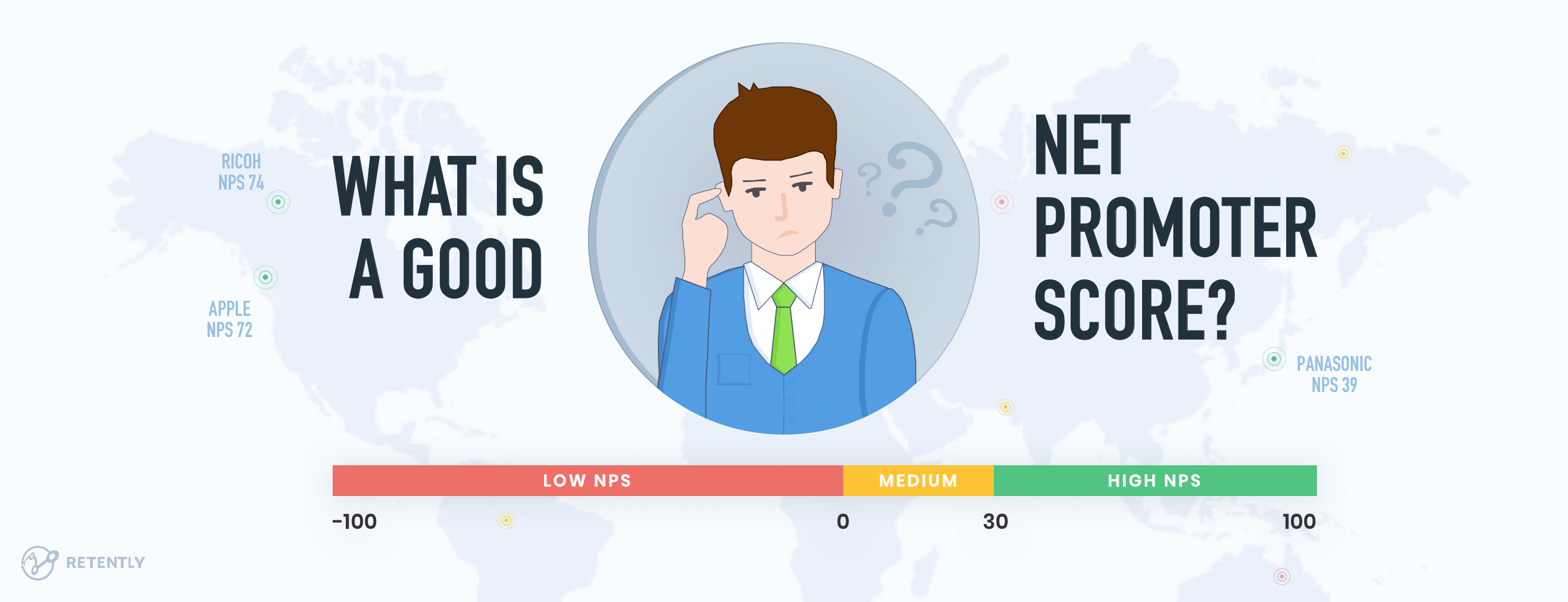

Your credit rating provides lenders which have a handy solution to determine exactly how most likely youre to repay the money you owe. The lenders availability their personal credit record that’s to the document during the all around three large credit reporting agencies.

The financing bureaus song how you pay-off any kind regarding borrowing from the bank you’ve been longer together with your bank card balance, commission arrangements, unsecured loans, and even whether or not you pay your book and expenses promptly.

A low credit history means that either you have had some trouble paying back money promptly in past times or which you only haven’t been playing with borrowing long enough to improve good ideal get. In any event, it is likely is a warning sign to possess prospective lenders.

Lower Get, Higher rate-Large Score, Low-rate

For those who have a diminished credit history (more than likely due to the fact you’ve struggled to expend back the debt or you’re younger and don’t has actually a lengthy credit score) lenders will protect by themselves in the imagined likelihood of credit your money getting an automobile from the asking a top interest on the hardly any money they lend you.

Fundamentally, a reduced credit history will certainly lead to increased focus rates or apr (APR) into the mortgage you receive. On the other hand, individuals with a high credit history (most likely while they have a good list out of paying down their financial obligation and/or he’s an extended credit rating) will pay reduced desire into financing and may be offered a lot more advantageous conditions.

Based on current vehicle financing business study, another table suggests exactly how other credit history range attract more and more high loan APRs.

Combination It

Actually, you simply is almost certainly not able to find that loan away from of several lenders whether your credit is poor. Although not, you’ll find loan providers which concentrate on poor credit otherwise no borrowing credit who you’ll offer a loan-but will normally charge a higher interest or levy even more fees.

Getting money into a motor vehicle beforehand when it comes to an advance payment commonly reassure lenders that you’re purchased paying the loan because you already own a hefty element of the vehicle. Paying to 20% of the cost of your car or truck ahead usually enable you to get a much lower rate of interest.