- October 20, 2024

- Posted by: Visa Imigration

- Category: payday loans no credit check and no bank account

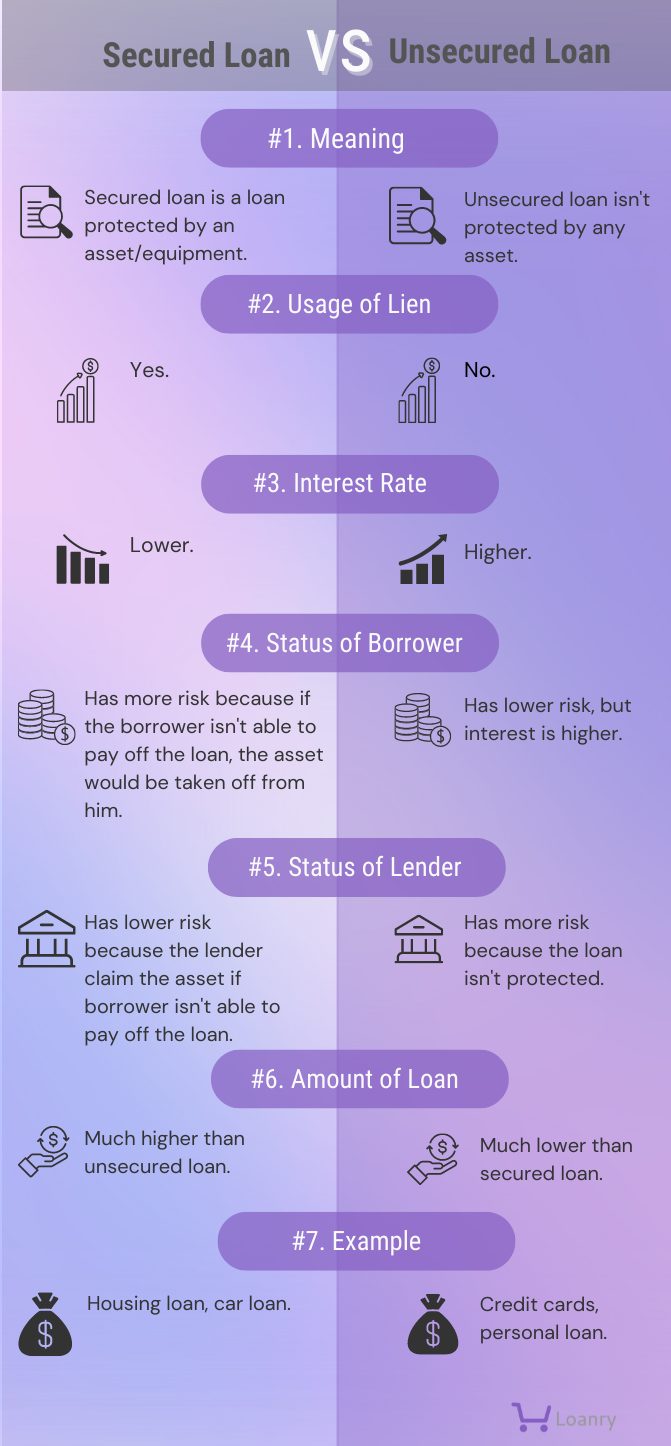

- You ought not risk make use of your house otherwise car while the collateral.

When you’re simply looking to deal with one or two domestic repairs or slight update projects, up coming a consumer loan could nevertheless be recommended to have you, especially if you require currency quickly. In some cases, like a broken Heating and cooling or mildew and mold infestation, the money can’t hold off. Similarly, for the an aggressive business, you are able to a consumer loan to buy a property to help you help you to get money easily to help you take on other even offers and you can strict work deadlines. This means that, unsecured loans can be a sensible way to obtain the funding you need below an excellent ticking clock.

House Renovation Loans

Since the a home recovery loan enables you to acquire based on the fresh new immediately following recovery worth of your residence, these are generally by far the most attractive choice for many strategies.

You see, renovations normally signify your home increases when you look at the worthy of, and you can a great average to be hired to the let me reveal that to have all $100k spent, homeowners will discover an increase in their property’s value because of the $75k.

And therefore particular money allows you to access which most worth initial absolutely help buy the project.

A great RenoFi Financing

Take-out an excellent RenoFi loan and you might make the most of borrowing from the bank stamina based on the residence’s immediately following repair well worth, without needing to refinance very first home loan.

These types of financing likewise have reduced fees, an adaptable name all the way to twenty years, plus the exact same low interest rates because the one domestic equity financing.

Check out this example to know how a good RenoFi mortgage can assist you to acquire the cash you ought to funds all your valuable recovery wishlist:

These types of money are created particularly to settle problems one residents was basically facing, and supply a function-based tool to greatly help loans renovations since prices-effectively that one may.

Cash-Aside Re-finance

If you have accumulated guarantee in your home, an earnings-away refinance can help you refinance the first home loan and you may release some of which.

However,, rather than a home reount you might obtain would depend abreast of your own residence’s current really worth, normally maxed out in the 80%.

With a profit-away refinance, their borrowing from the bank electricity is not nearly as expensive selection. You are able to need change your home loan seller, possibly shedding people reasonable-interest you are closed on the.

Add to this the fact you will become using closure can cost you and you will possibly a high rate than many other financing possibilities and you may its pretty easy to see as to the reasons really home owners should not play with a good cash-out refinance to possess home improvements.

Although this audio most readily useful, bear in mind that it requires age to store upwards enough loans to purchase price of this new projects that you like to carry out.

During this time period, you can have already been enjoying the advancements to your residence and you may while making sensible costs per month in place of and then make perform and you will dreaming of one go out having your permanently household over.

There’s absolutely no doubt those funds is the cheapest treatment for loans people renovation opportunity, small or big, although time it requires to store right up enough finance always function it isn’t a viable solution.

Consult with RenoFi

A good RenoFi financing shines against other funding choice. It can help you borrow the cash you prefer to suit your project without the need to refinance your current financial when you’re taking advantage of straight down charges and you may going for your term of between ten and you may twenty years.

- CalHFA

- Design Financing

- FHA 203k

- FHA Loan

- HELOC

- Home Security Finance

- Home improvement Finance

- Home Restoration Financing

A top interest rate leads to higher monthly payments, meaning that your property upgrade opportunity funded having a personal bank loan will surely cost a great deal more.

I encourage bringing rates away from step three-cuatro potential contractors to higher discover your overall opportunity can cost you dependent on your secret should checklist items. Talk to all of them in the thing will set you back and you will possibilities, also one deals they may be able to acquire your. Then, calculate your own monthly installments and you will contrast these to assembling your project finances to make sure you recognize how much you really can afford.