- October 22, 2024

- Posted by: Visa Imigration

- Category: payday loan no interest

Kristy was a self-employed contributor in order to Newsweek’s private loans team. As the an editor, Kristy did having internet like Bankrate, JPMorgan Pursue and you can NextAdvisor to hobby and develop posts to your financial, playing cards and you may money. The woman is plus created to own products instance Forbes Advisor and U.S. News and Industry. In her leisure time, Kristy enjoys travel, hitting-up railway tracks and discovering.

Ashley try an associate editor at Newsweek, having knowledge of user lending. This woman is passionate about creating one particular accessible private fund stuff for everybody clients. Ahead of Newsweek, Ashley spent almost 3 years during the Bankrate while the a publisher covering handmade cards, devoted to transactional stuff plus subprime and you will pupil borrowing from the bank.

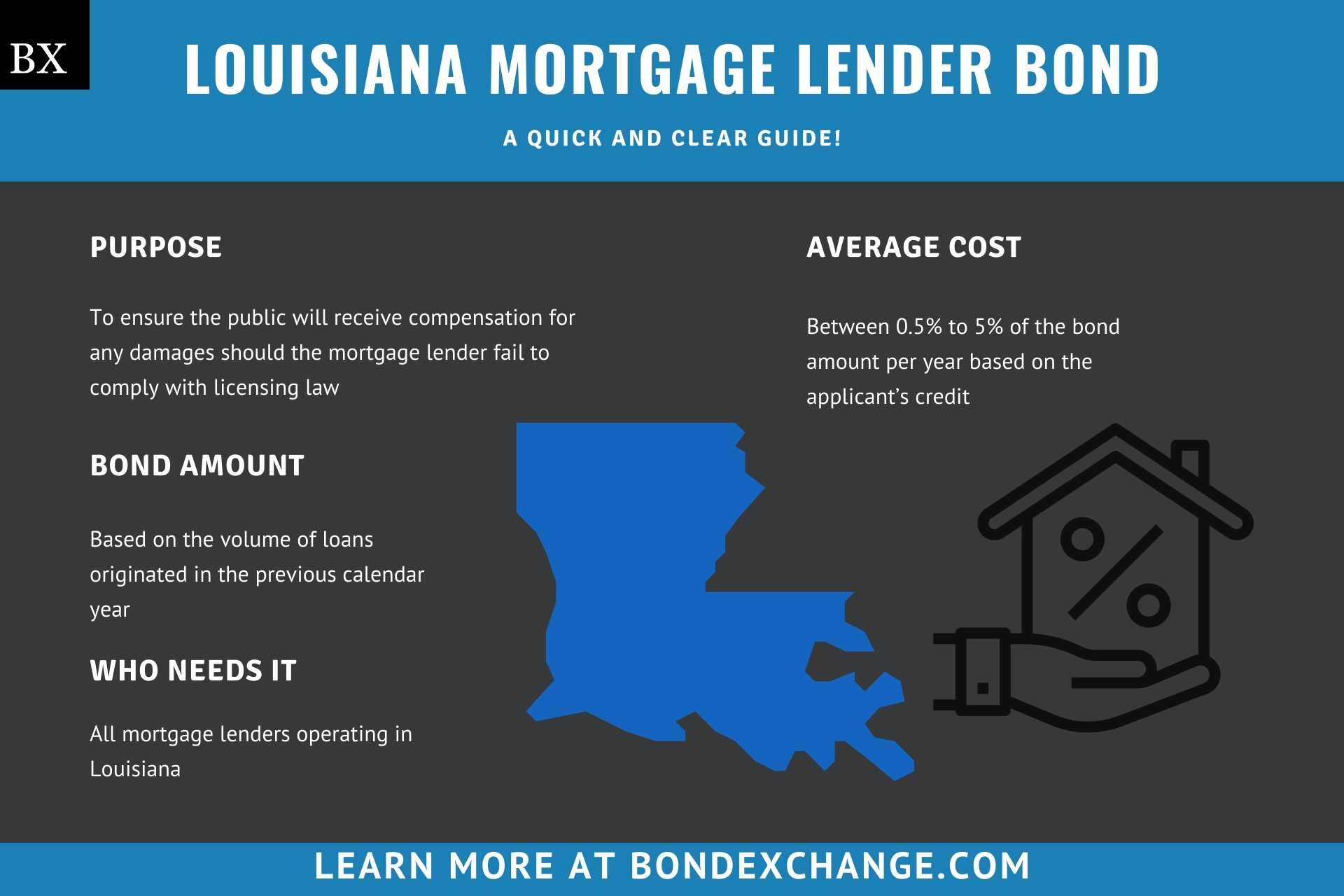

If you are looking to possess a way to score extra cash, you may be considering a property equity financing. Taking out fully a property collateral loan enables you to obtain away from the newest equity you’ve manufactured in your property. Yet not, household equity finance has actually several risks to adopt-such as the possibility of shedding your residence. Learn how to avoid household guarantee mortgage risks so you’re able to make an audio borrowing choice.

All of our scientific studies are built to present an extensive expertise away from individual fund products you to definitely work best with your circumstances. To throughout the decision-and then make process, all of our expert members contrast common choices and you can possible serious pain products, including affordability, use of, and trustworthiness.

Vault’s View

- When taking out a home guarantee mortgage, your home is at risk since guarantee.

- In the event the worth of your property change rather, you could find oneself under water in your mortgage.

- Taking right out a home collateral loan could also hurt your own borrowing from the bank get if you have excessive loans.

What exactly is a property Equity Loan and how Can it Performs?

A house equity loan is the place your acquire on security you have produced in your property. Equity will be based upon their house’s current ount you still owe in your home loan. Since you pay their financial, you will want to generate more and more collateral at which you can borrow.

You will have to implement with a lender to get a domestic collateral mortgage. Generally speaking, banking institutions only allow you to borrow as much as 85% of the equity you have of your property. Particularly, when you yourself have a property value $400,000 and still are obligated to pay $three hundred,000 on the home loan, you have got $100,000 in collateral. Who would make your maximum household equity amount personal loans for bad credit in Carolina borrowed $85,000.

The big Variety of Threats For the Household Equity Money

There is lots to look at prior to taking away a home collateral loan. Below are a few of your own poor household security financing dangers to help you consider prior to committing.

Shedding Your residence

That have a home guarantee loan, you reside collateral. For people who standard on loan, your financial contains the straight to foreclose to your property.

This task wouldn’t occurs just after one to overlooked percentage, however it can take place if you’re unable to buy multiple days consecutively. Your bank would not diving to getting your property-they may try a collection service or civil lawsuits earliest. However if these falter, you can lose your home.

Going Underwater in your Mortgage

Median home business cost across the country hit checklist levels in the quarter four away from 2022, with respect to the Government Set aside Financial. But subsequently, obtained come down, making the people vulnerable to supposed underwater on the mortgage loans. Getting under water into home financing occurs when you borrowed more money than just your home is value. This example is challenging should you want to sell your home since you would not make enough to pay your own home loan.