- November 26, 2024

- Posted by: Visa Imigration

- Category: advance payday loan company

Inside the first 12 months into the workplace, Roosevelt developed the Domestic Owners’ Loan Company to aid People in the us threatened having foreclosure from the converting quick-title finance into much time-term mortgage loans

New government off Franklin Roosevelt grabbed that intervention far next – and you may, along the way, drastically changed the way house was in fact funded in the us. New company was designed to buy the mortgages out of homeowners at risk of defaulting, after which re-finance this new money with increased useful words authorized because of the the bodies backing. Along side second two years, HOLC refinanced nearly one million mortgages. Although from the 20% out of home owners using HOLC in the course of time defaulted, the applying obviously spared most someone else regarding the same future from the easing their money and you will conditions.

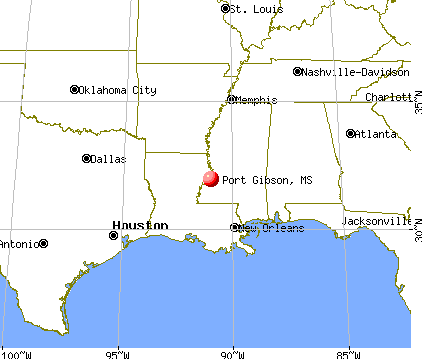

Yet crucial because the HOLC is actually, it actually was online payday loan Mississippi actually the Government Property Government therefore the Federal Federal Financial Organization (Fannie mae) – created in 1934 and 1938, respectively – you to definitely expanded the way Americans ordered their houses. In the first place built to improve family build, the FHA’s actual impact was at the way it altered the fresh mediocre home loan. Prior to the 1930s, homebuyers had been basically provided brief-identity mortgages long-lasting out-of five to help you 10 years and you will layer simply regarding the fifty% of one’s price of a home (the rest had to be set-up inside the bucks, making the purchase of a property a massive right up-front side resource). However, from the fresh new middle-1930s, brand new FHA considering insurance policies in order to loan providers to have mortgage loans that fulfilled particular requirements (particularly a minimum advance payment or borrower earnings). It lower the risks off credit, and thus lowering the cost of financing and you can enabling banking institutions supply home buyers top and extended home loan conditions.

The latest standard – one that would survive to own ortized 20- so you’re able to 29-seasons financial coating 80% of one’s cost of the house. These new mortgages considerably less off repayments and you will regular monthly premiums, and you can was basically very popular one to even loan providers maybe not and make FHA-supported finance delivered their mortgages towards line for the brand new terminology. Also, as much of risks of credit reduced, customers together with become taking advantage of a decline inside financial interest rates. The end result are a trend throughout the housing marketplace.

Because enough time-term mortgages try repaid reduced more than ages, they’re able to restriction a financing institution’s money on hand, thereby keep the establishment off to make any extra fund

In the first place a national agency (until 1968), its goal was to prompt a vacation home loan field who does help offer lenders which have higher liquidity, and so encourage alot more home loans. Fannie Mae’s purpose would be to get much time-term mortgage loans from these lenders – first having fun with taxpayer finance, and soon after using its own income – and therefore offering the loan providers towards the bucks they wanted to give so much more funds. The organization manage up coming change the brand new long-title mortgages on the securities, which it you’ll sell to increase more cash.

Fannie mae additionally the Federal Housing Management – combined with Veterans Government-insured mortgage loans created by the brand new Grams.We. Expenses shortly after The second world war – assisted to help make an article-war strengthening and you may household-control boom. Other, more reasonable incentives – most notably the fresh deductibility of loan focus from government income taxes – further advantaged owners over renters. And you may between 1940 and 1960, the house-possession rate in the us enhanced drastically – from 43.6% to help you 61.9%.

With techniques, this product proved to be good success – helping to make a home-owning middle-income group, and you will riding the fresh new article-war financial boom. But actually in the beginning, there had been dissenters. Inside the 1945, sociologist John Dean typed the ebook Owning a home: Will it be Voice? “The issue out-of home ownership, such as the remaining portion of the construction problem,’ tend to allegedly later on getting experienced directly by United states,” Dean authored. “Whenever that time arrives The united states have a tendency to undoubtedly review with the our very own go out while the a get older where community encouraged their family members so you can stride ahead because of an industry deliberately sown having booby traps.” But while standard prices having FHA-covered mortgage loans was more than those people with other finance, the fresh new booby traps one to Dean concerned with – residents enticed to go into on money they might maybe not maybe pay back – wouldn’t fully appear for many years.