- December 5, 2024

- Posted by: Visa Imigration

- Category: advance cash

The fresh new short respond to: Yes-financial pre-approval could affect your own borrowing from the bank. However, they mainly hinges on which kind of credit score assessment the financial really does. To know about the essential difference between a difficult credit score assessment and you will a flaccid credit assessment, pre-recognition and you may pre-qualification, keep reading.

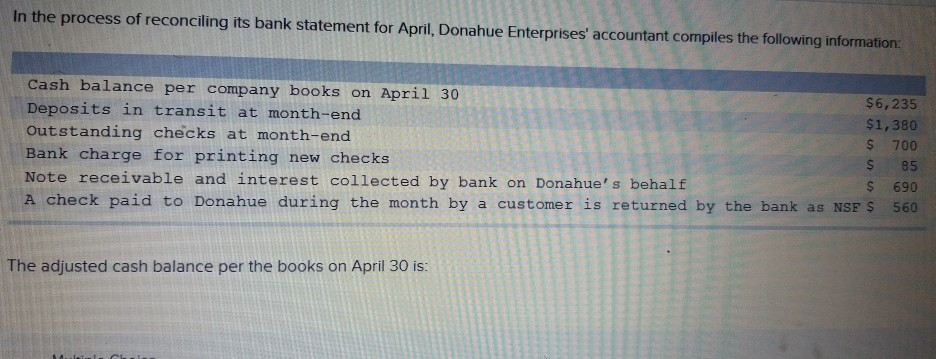

Why does home loan pre-approval performs?

Mortgage pre-approval happens when a home loan company confirms debt guidance so you can agree your to have an interest rate. Prior to looking for functions, it is wise to contact a lending company to obtain an idea of one’s amount borrowed you are going to qualify for.

Regarding the mortgage pre-acceptance processes, a home loan pro feedback your financial suggestions to decide just what home loan loan youre eligible for and provide you with loan solutions ahead of giving you a detailed imagine. You to definitely recommendations usually has the monthly mortgage payment, your own interest rate, plus the closing cost.

The monetary information the loan specialist studies when you look at the pre-acceptance techniques will then be accustomed influence the rate your qualify for in addition to mortgage matter. The new economic advice normally assessed will be your credit score, credit score, shell out stubs, taxation statements, monthly debt costs, lender comments, and homes commission history.

Always, their financial pre-acceptance will be best for as much as 3 months. The pace and you will financial brand new professional provides for your requirements often likewise have an established feature to work with when you are seeking properties. It will also enables you to cover the mortgage payments and figure out the highest worth of you’ll be able to purchase.

The major difference in pre-recognition and you can pre-qualification getting home financing is that pre-acceptance spends verified pointers in order to accept your for a loan and you can pre-qualification doesn’t. Instead of playing with confirmed information, pre-degree uses a price. Put simply, pre-certification spends a low-verified imagine of the type of mortgage you’ll be eligible for and offer you an estimate of one’s interest rate that you will end up using on your home loan.

Pre-recognition, on top of that, ‘s the a portion of the process where in fact the financial have a tendency to guarantee debt details and you may approve your on the mortgage. Simple fact is that area one to finishes along with you acquiring certified documents verifying the pace and mortgage dimensions that you can get from your lending company.

Pre-approval, that’s legitimate having 90 days, gets a written relationship of the home loan value. It’s cited having fun with affirmed pointers, spends data outlining your financial situation, and makes use of a painful credit inquiry. Pre-degree, at exactly the same time, estimates your value at a time, gets an earlier imagine out of affordability, which can be quoted using a personal-attested estimate. Moreover it uses replied inquiries on the financial situation which can be a personal-reported credit score.

Two a means to look at your borrowing:

There have been two ways to look at the borrowing from the bank: a smooth credit score assessment and a difficult credit assessment. Fundamentally, you’re one who would pick a mellow credit examine this is simply not seen by the other loan providers, and also zero impact on your credit rating. An arduous credit score assessment shows that a loan provider is just about to leave you borrowing, appearing when almost every other lenders run credit checks for Colony pay day loan alternatives you, also it can feeling your credit rating. Listed here is a much deeper glance at the differences when considering a silky credit check and you will a challenging credit score assessment:

Delicate credit score assessment. Loan providers explore smooth credit monitors when deciding whenever they will be pre-agree your for a charge card. A lender may also have fun with a mellow credit score assessment when your most recent bank draws a credit file to own a merchant account opinion otherwise whenever a loans enthusiast studies a current credit file. Examining the credit history also get logged given that a beneficial softer credit assessment.

Tough credit check. Lenders have fun with a hard credit score assessment, in addition, after you submit an application for that loan, aren’t a car loan otherwise a mortgage, otherwise a charge card. A difficult credit check demonstrates that you want to take on extra loans. It ought to be detailed, as well, one to most other potential loan providers will be able to see people tough borrowing from the bank monitors and can hence impression your credit score. Yet not, people bad affects will most likely just takes place if you take away multiple tough credit inspections.

Is actually pre-acceptance a painful credit assessment?

Sure. Pre-recognition is actually a hard credit check. Because concerns other activities deciding on more descriptive suggestions, lenders taking right out a difficult credit check you during pre-approval are a simple part of the borrowed funds recognition process. Tough borrowing from the bank monitors are thus techniques as loan providers promote finance to possess many money.